Speculators Club

Workshop on Training on NSMART

Date: 21 November 2023

The Faculty of Commerce and Management organized a Hands on training for the faculty members on 21st and 23rd November 2023.The session was led by Mr. G V Vijay Raghavan, Managing Director at Stockathon Academy, Bangalore. The objective of the session was to create an awareness about Investment opportunities in the stock market, virtual trading procedure and understand the options available for investors. He began the session with introduction to NSE and then he showed the features and procedure of NSMART Simulated Trading with examples. The faculties navigated through the interface and various tools options available under it. On the second day Sir taught the various order placing mechanisms and helped in doing demo trading with the help of NSmart. Vijay Raghavan sir solved all the queries raised by the faculties during the sessions. The session helped the faculties in understanding the potential risks and rewards of various trading strategies.

The two days training was an informative and interactive session, where faculties participated with full enthusiasm.

DARE TO START UP

Date: 30 October 2023

The Department of Professional Accounting and Finance proudly hosted a spectacular event on October 30th, 2023, under the banner of Festing Club "DARE TO START UP." This event, designed to encourage and showcase the entrepreneurial spirit of students, proved to be an inspiring journey. The day was brimming with activities, commencing with an inaugural ceremony, followed by a pitch competition, a crisis management challenge, and culminating in a grand valedictory ceremony. The event united the intellectual forces of all three year students. “Dare to start up” was a Premium Business Plan competition, with its own twist and challenges. The program prelims were based on Business Quiz, qualifies from 65 teams filtered and 19 best reached to the second round, Pitch Perfect. In this round they were required to show their marketing strategy along with an advertisement of their product or service. Each team was assigned a unique problem statement, ranging from addressing unemployment issues to solving problems related to clones, stagnant management, and promoting healthy lifestyles. The teams were meticulously evaluated by the judges based on creativity, business viability, innovation, originality, and logical reasoning. The participants were required to depict their initial ad through a video or live enactment and second part was pitching. Time frame was short for all the participants, they had to play very strategically to prove themselves and to be qualifier for final round, Survive and Thrive. Only seven teams emerged as finalists, earning the opportunity to participate in the "Survive and Thrive" round. This final round tested participants' ability to navigate real-life company crises, scrutinizing their problem identification, decision-making skills, ethical considerations, and their ability to devise impactful and risk-mitigating strategies.

They were given another hurdle inform of AV cases from industry based on Patent, copyrights, Financial scams, PR, etc They had only 2 minutes to think for solutions to the case. In the end, "Team Inmobi" ( Yash Kothari, Ishika Kothari ,Pranav Nair, Ganavi) II Year Business Analytics (P6) demonstrated exceptional crisis management skills, clinching the top spot as the event's winners. They were followed by "Team OYO" ( Kenza Maryam Mustafa, N V Chanaswi , Riya Dutta , Aaron Ansel Thomas) II Year Business Analytics (P5) as the first runner-up and "Team Upgrad" ( Kishor Sibi, Anchana Krishna, Jingle Jiju, Priyanka Shettyas) II Year Business Analytics P5 the second runner-up. The audience watched in awe as these teams expertly handled real-world business challenges.

From first round to third round, all their performance, decision power, spontaneity, creativity, out of the box approach, attitude, everything was roasted from two esteemed Stewarts from industry. Judges extreme knowledge and expertise, helped them to understand real time changes. This DARE TO START UP platform was not superficial, it was real as it happens in any business plan completion, but with extra level of difficulties. These extra difficulties made them, more profound in their ideas and skill navigation. The event culminated with heartfelt expressions of gratitude for Mr. Rejoy John Consultant, BrandMeUp Creative LLP and Mr. Tharun Panchala, Founder Wanderfly and a sincere acknowledgment of the unwavering support from the Department Head, Dr Annie Stephen, FCA and faculty coordinator Dr. Nidhi R Gupta. The event was also conducted with the aim of developing skills in the advanced learners and granting a platform to the budding entrepreneurs to brainstorm enterprising ideas.

World Investors Week 2023

Date: 25 to 31 October 2023

Every year the Department of Professional Accounting, speculators club conducts sessions during the World Investors Week. The session is usually conducted by external and internal resource persons. This year sessions were conducted on 25th, 26th, 27th, 28th, 30th and 31st of October 2023.

On Day one, the resource person Mr. Sunil Kolangara, Co-founder of Unaprime discussed on how work and career are connected to investments. Sir gave emphasised on the basis of investments, ethical practices, segmentation of industry etc. Sir has encouraged the students to understand their strengths and weaknesses to identify their role in stock market. On Day two, talk on "Investment in Banking" was taken by Mr. Ashraf KA where, Vice President, HDFC Bank, Sir focused on high-stakes financial career that involves providing advisory and financial services to corporations, institutions, and governments. The talk aimed to enhance participants' understanding of investment banking practices, financial markets, and investment opportunities, ultimately empowering them to make informed financial decisions and explore career prospects in this industry.

On Day three, Ms. Sherin Chacko gave an overview of the fundamental concepts and functions of investment banking. It also aimed to offer insights into the role of investment banks in the financial market and their crucial functions in facilitating capital raising, mergers and acquisitions, and various financial advisory services.

CA Akhil Manuel led a session on derivatives markets through online mode on the fourth day. Sir spoke about Meaning, kinds, applications, and an explanation of many derivatives. Dr. Kiran Kumar's lecture on Market Mastery: Technical Insights was held on the fifth day. Sir covered topics such as stock market trends, historical trend analysis, risk management, IPO investment strategies, and the Gray Market.

On the final day, treasure hunt was conducted in and around the college with 35 teams of 4 members each. Participants were tested on their aptitude and critical thinking skills. The clues were hidden around the college and Top 4 teams were selected for the final round. This round focused on the participants' stock knowledge and negotiation skills, giving them a unique crossword puzzle to solve. The questions were also related to the stock market and finance, which helped the students acquire vital skills ahead of time.

Investor Awareness on Benefits of Investing in Mutual Funds

Date: 14 September 2023

Speculators Club in association with HDFC Mutual Funds organized an Investor Awareness on Benefits of Investing in Mutual Funds. The resource person for the session was Dr. Balaji Rao DG, MBA, PGDMM, PGDFA, PhD - HDFC Mutual Fund, Bangalore. The main objective of the session was to provide a comprehensive overview of one of India’s leading mutual funds. Mutual Fund offers a wide range of schemes catering to different investment objectives and risk appetites. The lecture highlighted Mutual Fund commitment to delivering consistent and long-term returns for investors. Sir explained the favorable and unfavorable(risks) factors involved in investing in mutual funds. Areas such as right identification of stock, wealth creation and profit booking were touched. It was an illuminating and enlightening session.

The session on HDFC Mutual Fund offered valuable insights into the company & history, product offerings, investment philosophy, and services for investors. It underscored the importance of informed decision-making and understanding the risks associated with mutual fund investments.

Investor Awareness Programme

Date: 25th February 2023

Retail investors have shown an inclination towards small-cap funds, adding to the largest number of folios in such schemes. Mutual funds are known to be one of the most preferred investment instruments. To create awareness of Mutual Funds and their features and tax implications, the Department of Professional Accounting and Finance organized a Skill Development Lecture on Investor Awareness Programme with a special focus on Mutual Funds on 25th February 2023, through the online mode. The session was organized with the aim of creating awareness of Mutual funds and their operations.

The session highlighted the importance of Mutual Funds and its operations. Mr Rishab Lunia throw light on the Systematics Investment Plan, various mutual fund schemes, and the benefits attached as well as a brief on the operations of mutual funds.

The speaker also explained why mutual funds are the finest investment option for future investment plans. The session was interactive and all queries posed by the participants were addressed by the speaker.

Investment Awareness Prorgamme on Capital Markets

Date: 22 February 2023

Successful Investing is about managing risk, not avoiding it”-Benjamin Graham.

The Department of Professional Accounting and Finance organized a Skill Development Lecture on the Investor Awareness program focusing on capital markets in India on 22nd February 2023, through online mode. This seminar was organised to create awareness of Indian capital markets and savings and investments.

The Resource person, Mr. Rahul Dhawan, is a Trainer at Jai Vatnani & Company, Mumbai. Mr. Rahul created awareness among the students about the functioning of the capital market and emphasized the investment options available in the market and how one could make a choice among the vast pool of investment opportunities. Resource persons explore the importance of Mutual Funds, and their types, where to invest, making short and long-term financial goals followed by SIP - the power of compounding and Dos and Don’ts while investing in any assets. The session concluded with an open discussion with the students wherein the resource person clarified their queries with regard to investment decisions and the most viable options. The session was very comprehensive and enriching.

Innovative Investing

Date: 30th September 2022

World Investor Week (WIW) – an International Organization of Securities Commissions (IOSCO) initiative, is a global investor awareness campaign. WIW is celebrated every year, across the world, by the securities market regulators. The week witnesses a host of investor awareness activities across the globe and the investors are explained about the importance of investor education and protection.

Joining hands with the intent of creating awareness and investor protection, the Speculators club conducted a session on the occasion of the World Investors Week titled Innovative Investing. The session was led by Dr. K. Kiran Kumar Faculty Co-ordinator- Speculators Club.

Amid growing retail participation in equity markets, the investor awareness programmes and education play an important role in helping new investors make informed decisions. It is essential that investors do not get lured by false promises and unsolicited advice. The attractive avenues for investments were discussed at length. The speaker also spoke about the importance of Investment and Savings and shared the life cycle of an Investor at various stages. He also he spoke about Crypto Currency, Non fungible Tokens, Crowd Funding with current Ponzi schemes and case studies and shared the advantages and disadvantages of different investments. The session was informative.

Introduction to Securities Market

Date: 29 September 2022

The Department of Professional and Accounting and Finance, in collaboration with the Speculators Club, Kristu Jayanti College, Autonomous, Bengaluru and in association with SEBI, NSE and NSDL organised a seminar on "Introduction to Securities Market" on September 28, 2022. The event was organised as part of the World Investor Week organised by the Speculators Club. The guest speakers of the event were Mr. Edward Marandi-Deputy General Manager, SEBI, Ms. Garima- Manager, SEBI, Mr. Ravi Uppe- Deputy Manager, NSE and Mr. Supratim Mitra- AVP, NSDL.

The session began with interactive questions by Mr. Edward in order to understand the knowledge and awareness levels of the students. He highlighted the need for investments, shared the concepts of Capital Market and also shared the Golden theory of Finance. He laid emphasis on the fact that all participants should be "informed investor". The session was continued by Ms. Garima who gave insights on the role of securities markets, importance and works done by SEBI, prerequisites of buying and selling, Initial Public Issue and also on the benefits of Mutual Funds. She also emphasised on the rights of shareholders and also the do's & don'ts of buying and selling. The next session was conducted by Mr. Ravi who gave information on the trading account opening and order placement process. He also shared insights on the good practices of a prudent investor and also informed the various Investor Grievance Redressal platforms. The final session by Mr. Supratim was on the Depository services and the role of Depository services. He also highlighted the importance of ISIN which they term as the "birth of a company". The session ended with Q & A.

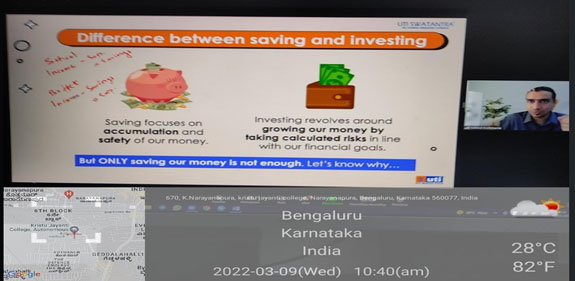

Skill Development Lecture on Feel The Magic of Trading

Date: 29 September 2022

The Speculators club conducted a session on the commemoration of World Investors Week on the topic of Feel the magic of trading. The objective of this skill development lecture was to give an insight on the trading procedures through live session and live examples. The session was led by Dr. K. Kiran Kumar, Faculty Coordinator. He began the session with an introduction on the way in which money can be used- Save, Spend and Invest. He explained the Live Trading procedure with various examples by using DSIJ virtual trading App. He gave a brief insights on Buy and Sell strategies like how to buy, why to buy and what are the reasons to buy before investing in the stock market. Furthermore, he discussed about the recent IPO’s in India like LIC IPO and PayTM IPOs with their advantages and disadvantages. The session was interactive and invited an open discussion with the students.

Introduction to Securities Market

Date: 28th September 2022

The Department of Professional and Accounting and Finance, in collaboration with the Speculators Club, Kristu Jayanti College, Autonomous, Bengaluru and in association with SEBI, NSE and NSDL organised a seminar on "Introduction to Securities Market" on September 28, 2022. The event was organised as part of the World Investor Week organised by the Speculators Club. The guest speakers of the event were Mr. Edward Marandi-Deputy General Manager, SEBI, Ms. Garima- Manager, SEBI, Mr. Ravi Uppe- Deputy Manager, NSE and Mr. Supratim Mitra- AVP, NSDL.

The session began with interactive questions by Mr. Edward in order to understand the knowledge and awareness levels of the students. He highlighted the need for investments, shared the concepts of Capital Market and also shared the Golden theory of Finance. He laid emphasis on the fact that all participants should be "informed investor". The session was continued by Ms. Garima who gave insights on the role of securities markets, importance and works done by SEBI, prerequisites of buying and selling, Initial Public Issue and also on the benefits of Mutual Funds. She also emphasised on the rights of shareholders and also the do's & don'ts of buying and selling. The next session was conducted by Mr. Ravi who gave information on the trading account opening and order placement process. He also shared insights on the good practices of a prudent investor and also informed the various Investor Grievance Redressal platforms. The final session by Mr. Supratim was on the Depository services and the role of Depository services. He also highlighted the importance of ISIN which they term as the "birth of a company". The session ended with Q & A.

Smart Investor

Date: 27 September 2022

The Department of Professional Accounting and Finance in association with the Speculators Club celebrated the World Investor Week. The day 1 of the World Investor Week was held on 27th September 2022 at Kristu Jayanti College and the speaker of the day was C A Sreedevi P Menon, Asst. Professor of Kristu Jayanti College.

The speaker started the session with a brief note on World Investor Week. The theme of the World Investor Week was highlighted and the speaker continued the session to understand the awareness of the participants on few key terms like DEMAT Account, Stock Exchange, Depository Participant, IPO and SENSEX. Further the speaker spoke about stocks that are part of NIFTY 50 and its historical returns. The students were educated about different types of securities in the market like equity, debt, derivatives, mutual funds, future & options. The speaker touched upon the fact that valuation is the key to determining value of a share in an IPO. Some tips & tricks of trading of shares were highlighted by the speaker. The speaker also shared her experience of trading or investing. The session concluded with a crossword puzzle activity. It was an interactive and informative session.

Awareness of Mutual Funds

Date: 27th August 2022

Successful Investing is about managing risk, not avoiding it”-Benjamin Graham.

The Department of Professional Accounting and Finance organized a Skill Development Lecture on Awareness of Mutual Funds focusing on effective wealth creation on 15th September 2022, through online mode. This seminar was organised to inculcate the idea of mutual funds among the students of first year.

The Resource person, Mr. Rahul Dawan, is a Trainer in Jai Vatnani & Company, Mumbai. Mr. Rahul Dawan stated that there is never a perfect time to learn or invest, but there is always a right time and a wrong time. He further explained that asset allocation and Portfolio management plays a major role in investment and expressed that when inflation is low, the investors feel that they know more about the future, and are much more willing to take risks. The session focused on beginners’ level of understanding on investment portfolio and their management and also on topics such as working of mutual funds, equity and debt schemes, scheme related documents, international funds, index bench marks and other related topics on investing.

The session was very comprehensive and enriching.

Beginners Guide to Cryptocurrency

Date: 10-03-2022

Beginners Guide to Cryptocurrency organized by the Speculator’s Club, Department of Professional Accounting and Finance of Kristu Jayanti College, Autonomous Bengaluru.

Dr. Kiran spoke about cryptocurrencies powered by a technology called a block chain. It is a list of transactions that anyone can view and verify for example contains a record of every time someone sent or receive a bitcoin. This system is built from blocks of data that are chained together in chronological order. Sir also discussed the process of buying and selling cryptocurrency with the help of a flow chart. He called cryptocurrency money 2.O. and how the issue of funds through crypto is the future. Dr. Kiran spoke about sources of obtaining cryptocurrencies through mining followed by advantages and disadvantages of cryptocurrency and how they are becoming sources of finance for illegal activities. Finally, the session was ended with doubts clarification raised by the participants. It was indeed an enriching session.

Investors Awareness Programme on Finance Literacy

A skill development session was organized by the Speculator’s Club of the Department of Professional Accounting and Finance - Kristu Jayanti College, Autonomous Bengaluru.

The resource person for the session was Mr. Milind Kohmaria, Certified Financial Planner- Parivartan Learning Solutions, Mumbai. The main objective of the session was to enlighten the students on the importance of Savings and investment and the different investment opportunities available in India.He stressed on need and importance of saving and investment for future benefits to develop a preparedness in case of contingencies in future. He also shared his thoughts on the impact of inflation and also the ways and means of wealth creation. Mr Milind shared insights on the power of compounding, building the discipline of regular investing and how to set financial goals. He also emphasized on SIP, Mutual Funds Risk Appetite and Investment horizon. It was indeed an enriching session.

Skill Development Lecture on “Capital Market Awareness”

Department of Professional Accounting and Finance organized skill development lecture on “Capital Market Awareness” on 23 November 2021 through virtual platform. Mr. Pankaj Mathkar, Associate, Lotus Knowlwealth Pvt. Ltd addressed the students.

Mr. Pankaj Mathkar created awareness among the students about functioning of capital market. The trading process, trading timings, and risk involved in capital market were explained to the students. Mr. Pankaj Mathkar described about the categories of assets along with its salient features focusing on return, safety and liquidity. He also highlighted the Mutual funds and its types and various schemes of mutual funds. The speaker gave detailed explanation on do’s and don’ts of investors, rights of investors, obligations of investors and investor grievance redressal mechanism. The session ended with open discussion and participants gained the knowledge.

Skill Development Lecture on “Capital Market Awareness”

Department of Professional Accounting and Finance organized skill development lecture on “Capital Market Awareness” on 27 September 2021 through virtual platform. Mr. Pankaj Mathkar, Associate, Lotus Knowlwealth Pvt. Ltd addressed the students.

Mr. Pankaj Mathkar created awareness among the students about functioning of capital market. The trading process, trading timings, and risk involved in capital market were explained to the students. Mr. Pankaj Mathkar described about the categories of assets along with its salient features focusing on return, safety and liquidity. Mutual funds, its types and various schemes of mutual fund was also briefed to the students. The speaker gave detailed explanation on do’s and don’ts of investors, rights of investors, obligations of investors and investor grievance redressal mechanism. He also provided guidance to the students about preferred investment scheme for students.

The session ended with open discussion. The queries raised by students their regarding capital market investment were clarified by the speaker. The skill development lecture helped the students to create awareness about stock market and how to invest the money by diversifying risk.

Skill Development Lecture on “Capital Markets in India”

Department of Professional Accounting and Finance organized skill development lecture on “Capital Markets in India” on 23 September 2021 through virtual platform. Mr. N. Mahesh Kumar, Co-Partner, Ashirvad Financial Services, Lotus Knowlwealth Pvt. Ltd addressed the students.

Mr. N.Mahesh Kumar created awareness among the students about functioning of capital market. The trading process, trading timings, and risk involved in capital market were explained to the students. Mr. Mahesh Kumar described about the categories of assets along with its salient features focusing on return, safety and liquidity. Mutual funds, its types and various schemes of mutual fund was also briefed to the students. The speaker gave detailed explanation on do’s and don’ts of investors, rights of investors, obligations of investors and investor grievance redressal mechanism. He also provided guidance to the students about preferred investment scheme for students.

The session ended with open discussion. The queries raised by students regarding capital market investment were clarified by the speaker. The skill development lecture helped the students to create awareness about stock market and how to invest them

Ways of effective wealth creation

The Speculators Club from the Department of Professional Accounting and Finance organized a skill development lecture titled “Effective Wealth Creation” in association with SEBI.

The session was led by Mr. Thangaraj, Senior Associate, Jai Vatnani Company. He shared insights on investment options available in the market and the how one could make a choice among the vast pool of investment opportunities. He also highlighted the importance of Mutual Funds, and its types and international funds. Determining where to invest, making short and long term financial goals, SIP - the power of compounding, -SWP (systematic withdrawal plan were also discussed at length. The session concluded with an open discussion with the students wherein the resource person clarified their queries with regard to investment decisions and the most viable options. The session was informative.