Faculty

Faculty Colloquium

Dr. G Arockia Stalin, an Assistant Professor in the Department of Professional Accounting & Finance, discussed the analysis of the Indian Stock Market post Covid-19. He highlighted that returns indicate changes in asset prices over time, either in terms of price or percentage change, with positive returns indicating profits and negative returns representing losses. Additionally, he demonstrated the use of Excel features to predict stock prices based on stock returns, providing valuable insights for investors, shareholders, and analysts in making informed investment decisions by considering historical prices from the Bombay Stock Exchange.

Dr. J. Poornima, an Assistant Professor in the Department of Professional Accounting & Finance, presented on "Neo Banking" during the Faculty Colloquium. The talk shed light on the fintech revolution in India, with a focus on Neo banks as disruptive players in the traditional banking ecosystem. The speaker discussed the distinctions between Neo banks and traditional banks, their functions, the regulatory framework provided by the RBI, and provided insights into the future of Neo-Banking in India and globally.

Dr. Nitty Antony, an Assistant Professor in the Department of Professional Accounting & Finance, discussed "Micro Learning" during the Faculty Colloquium, highlighting its significance in the post-COVID education landscape. The session emphasized the need for concise lectures that deliver essential information in a shorter timeframe, as learners prefer this approach. The speaker stressed the importance of strong micro content and provided insights on creating engaging videos to support micro learning, while also exploring online platforms for developing such teaching materials.

Dr. Aakash Kumar, an Assistant Professor in the Department of Professional Accounting & Finance, delivered a presentation on the 'Paradox Theory.' The session explored the purpose of paradoxes, which are a combination of conflicting thoughts that go beyond simple opposition. While paradoxes can be stressful to confront, understanding and managing them helps individuals gain mastery in life. Paradoxes are also utilized by monks in Eastern traditions as tools for enlightenment. The presentation covered five important paradoxes, including the Liar's Paradox, Paradox of the Court, Omnipotence Paradox, Smullyan's Paradox, Dr. Aakash Kumar, an Assistant Professor in the Department of Professional Accounting & Finance, delivered a presentation on the 'Paradox Theory.' The session explored the purpose of paradoxes, which are a combination of conflicting thoughts that go beyond simple opposition. While paradoxes can be stressful to confront, understanding and managing them helps individuals gain mastery in life. Paradoxes are also utilized by monks in Eastern traditions as tools for enlightenment. The presentation covered five important paradoxes, including the Liar's Paradox, Paradox of the Court, Omnipotence Paradox, Smullyan's Paradox, and Zeno Dichotomy Paradox. Furthermore, paradoxes serve as valuable tools for management theory students to comprehend the challenges faced by managers in business. For instance, the paradoxical nature of employees being both individuals and part of an organization can be better understood by considering both perspectives, enabling managers to improve their handling of workers' lives at work

Staying relevant’ in the current age

Date: 23-02-2022

Ms. Ruth Thomas, Teaching Assistant, Dept. of Professional Accounting & Finance talked on the importance of ‘staying relevant’ in the current age . She mentioned the different categories of generations that currently exist and how it has caused an issue of ‘generation gap’. She also emphasized on the importance of venturing into social media and utilizing it to increase knowledge as well as staying updated on the changes in tastes and patterns in the world, especially in the classroom. She discussed upon various resources and tools that can be used to update oneself including the advantages of taking up an online course to develop on ones existing interest or creating new interests. Ms. Ruth reiterated that it was okay to ask questions when learning something new by quoting the words of George S. Patton Jr. that “when in doubt, observe and ask questions. When certain, observe at length and ask many more questions.’

Enhancing Stress Management Skills among Teachers

Date: 19/02/2022

Dr.S.Jayashree, Assistant Professor, Department of Professional Accounting & Finance have delivered a speech on “Enhancing stress management skills among teachers”. She said that in the present century, teaching is becoming more challenging as a profession. The role of the educators, their responsibilities and the teaching activities are influenced by fast changing educational process which result into stress and the psychological well-being of an individual is affected.

Hence, she highlighted that teachers should follow strategies like flexi-timing, avoiding unnecessary interruptions, following efficient relaxation techniques on the weekends, schedule work effectively in order to maintain a positive work life balance. She discussed upon other coping strategies like stress management programs, physical activities, stress-audit, life style modification programs, supportive organization culture, spiritual programs in order to be healthy and stress free. She mentioned that formulating preventive and remedial strategies by the institutions can help to keep the employees away from stress and maintain work life balance.

Transforming Teaching Methodologies in Class

Date: 22/09/2021

Dr. Reenu Mohan, Assistant Professor, Dept. of Professional Accounting & Finance spoke on transforming teaching methodologies in class. The onset of the Covid-19 pandemic has led to a lot of unprecedented changes in the world. Many educational institutions, including students and teachers had to adapt to remote learning which posed many challenges, especially for the teachers, who have been striving to provide quality education without compromising the process and techniques of teaching. She mentioned the strategies adopted during the pandemic and how the faculties embraced the change in teaching methodologies. She emphasized on the importance of nanolearning and asynchronous learning for the students. She discussed upon various resources and tools that can be used to make the classes more engaging and innovative. Dr. Reenu reiterated that the faculties must continuously learn and keep themselves updated. She also shared details of the open source tools for e-content development.

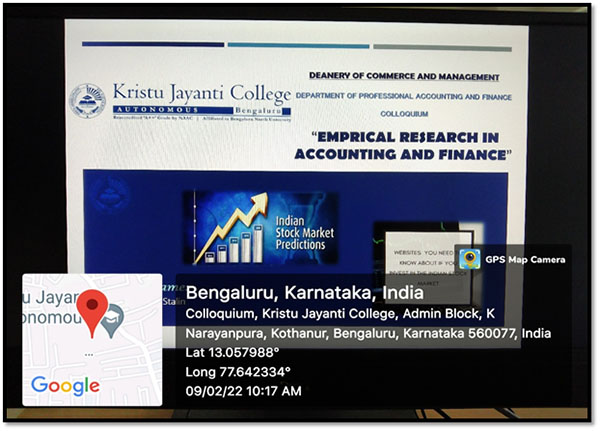

Empirical Research in Accounting and Finance

Date: 25/08/2021

Beneficiaries: Faculties

Name and details of the resource person: Dr. S.RAJI Assistant Professor, Kristu Jayanti College (Autonomous), Bengaluru.

Dr.S. RAJI, Assistant Professor, Dept. of Professional Accounting & Finance spoke about NFT (Non Fungible Token). Non – Fungible Assets: Assets that are incapable of mutual substitution, not interchangeable, e.g Art, Deeds, and diploma etc., NFTs which acts like a digital certificate of authenticity. The market for NFTs ballooned in 2020, climbing to market cap of at least 338 million from about 41 million in 2018. NFTs are Unique cryptographic tokens that exist on a block chain and cannot be replicated. NFTs can be used to represent real world items like artwork and audio etc. Token is nothing but certification of ownership. NFTs can also be used to represent peoples identities, property rights and more. NFTs can remove intermediaries, simplify transactions, and create new markets. No middleman work.

Block chain technology

Date: 18th August 2021

Block chain is a specific type of database, an electronic record-keeping technology. A database is a collection of information that is stored electronically in a computer system. It differs from a typical database in the way it stores information, Block chains store data in blocks that are then chained together.

As the new data comes in, it is entered into a fresh block, once the block is filled with data it is chained on to the previous block, which makes the data chained together in chronological order.

Different types of information can be stored on a block chain but the most common use so far has been as a ledger for transactions.

The concept of bit coin is also based on block chain technology. In case of bit coin, block chain is used in a decentralized way so that no single person or group has control –rather, all users collectively retain control.

The advantages of decentralized block chain is immutable, which means that the data entered is irreversible. The transactions are permanently recorded and viewable to anyone.

Some state governments like AP, Telangana have started block-chain related solutions in areas of land registry, digital certificates, electronic health records etc.

RBI proposed block chain technology for cross border payments, trade finance for MSMES in public sector banks as well.

Private banks like Yes Bank, Axis Bank , HSBC introduced block chain technologies in the fields of international payment, commercial papers , trade finance transactions etc.

Recently block chain technology is also used in health care sector, HR field, Government services, And Venture capitalists etc.

Blending of block chain social media will solve problems in social media related to privacy violations, tortious scandals, data control and content relevance. Published data in the social media domain remain untraceable and cannot be duplicated. It ensures that the power of content relevance lies in the hands of those who created it, instead of the platform owners. Block chain technology will help deliver solutions which will establish transparency and trust.

Advantages of block chain technology

• Lower transaction cost.

• Protection from cyber-attacks.

• Maintain confidentiality and operate in a closed ecosystem.

CBDC (Central Bank Digital Currency)

Date: 11/08/2021

Beneficiaries: Faculties

Name and details of the resource person: Mr. K. Kiran Kumar, Assistant Professor, Kristu Jayanti College (Autonomous), Bengaluru.

Mr. K. Kiran Kumar, Assistant Professor, Dept. of Professional Accounting & Finance spoke about CBDC (Central Bank Digital Currency), and its working operations and how it is going to support to the flow of currency in the Indian Economy, he also deliberated on importance of digital currency which is issued by the RBI when it was approved by the Central government as legal tender. He also highlighted the following concepts: RBI polices with regard to CBDC, current alternatives, how inflation can be control with CBDS and advantages, disadvantages of CBDC followed with Legal Framework.

Faculty Achievements

Faculty Development Programmes

Exploring connections: Social Emotional Learning and Student success

Date: 28 January 2025

The Department of Professional Accounting and Finance organized Faculty Enrichment Programme on was conducted on 28th January. Dr. Sapna Thwaite, Provost of Michigan University and Dr.Zechariah Mathew, Director for Centre for global engagement were the resource persons. The session aimed at equipping educators in fostering a supportive and effective learning environment to enhance faculty engagement with students

Dr. Thwaite emphasized the importance of recognizing students’ diverse backgrounds, learning styles, and individual challenges. She encouraged faculty members to adopt a student-centered approach to teaching, ensuring that every learner feels valued and understood. Dr. Thwaite explained that a sense of belonging leads to higher student engagement and motivation.The discussion extended to fostering an atmosphere where students feel safe to express their thoughts, ask questions, and take academic risks without fear of judgment. She suggested ways to build trust and encourage open dialogue in classrooms. Faculty members were encouraged to build strong student-teacher relationships.

Dr. Zechariah introduced frameworks for assessing student competencies effectively. He stressed the need for preparing students for the job market. Dr. Zechariah shared insights on integrating skill-based learning, critical thinking, and real-world applications into the curriculum. He also discussed industry expectations and the importance of soft skills in career development.

The Faculty Enrichment Programme was an insightful and engaging session. The expertise and practical guidance provided valuable perspectives on creating a nurturing academic environment that fosters student success. The session was well received and served as a significant step towards enhancing faculty-student engagement and employability outcomes.

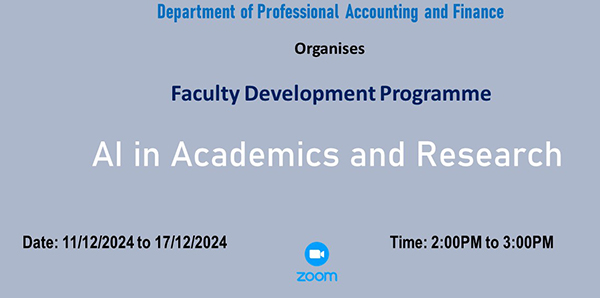

Faculty Development Programme on AI in Academics and Research

Date: 11 to 17 December 2024

The Department of Professional Accounting and Finance at Kristu Jayanti College, Bengaluru, organized a six-day Faculty Development Programme (FDP) from December 11th to 17th, 2024 and focused on the theme “AI in Academics and Research.”

The sessions began with an introduction to researching with AI by Dr. Vijaya Kittu Manda on day one. He demonstrated how AI tools like Scite, Research Rabbit, Connected Papers, Iris.ai, and Semantic Scholar can streamline the research process by providing quick access to relevant literature, suggesting related research papers, and identifying key insights. Participants learned how to harness these tools to enhance the efficiency and accuracy of their research endeavors.

It was followed by a session on the art of citation and AI tools for sourcing literature, presented by Dr. Anand Shankar Raja M. Tools such as Zotero, Mendeley, EndNote, RefWorks, and Cite This For Me were highlighted for their ability to organize references, generate citations in various formats, and streamline the literature review process. Dr. Raja M emphasized the importance of maintaining academic integrity through proper citation practices.

On day 3, Dr. S. Sujatha discussed AI tools for literature review. She introduced participants to tools like Scholarcy, Litmaps, Meta, ResearchGate, and QuillBot. These tools help summarize complex articles, map out research trends, and paraphrase text to avoid plagiarism. Dr. Sujatha provided hands-on exercises to demonstrate how these tools can significantly improve the literature review process.

Dr. C. Gomathy, Assistant Professor at PSGR Krishnammal College for Women, highlighted various AI writing tools on day four. She showcased tools such as AI Humanize, Wordtune, Grammarly, ProWritingAid, and ChatGPT. These tools assist in refining content, improving clarity and coherence, and enhancing the overall quality of writing. Participants explored practical applications of these tools to draft, edit, and polish their academic writings effectively.

Mr. Royal Praveen D'Souza, Assistant Dean at the School of Information Science and Technology, St. Aloysius (Deemed to be University). He explored AI chat, summarizer, and paraphraser tools such as Quillbot, SMMRY, Paraphrase Online, ChatGPT, and TldrThis. These tools enable efficient communication, quick summarization of texts, and rephrasing of content to maintain originality. Participants practiced using these tools to enhance their writing productivity and ensure plagiarism-free work.

Dr. Reji P. John, Assistant Professor at the School of Arts and Humanities, St. Aloysius (Deemed to be University) focused on AI tools for data analysis and visualization, introducing tools like Tableau, Power BI, Orange, KNIME, and Google Data Studio. These tools help transform raw data into meaningful insights through interactive and visually appealing presentations. Dr. John conducted practical sessions, allowing participants to apply these tools to real-world data sets and create impactful visualizations.

These detailed sessions equipped participants with the knowledge and skills to effectively integrate AI tools into their academic and research practices, ensuring they stay at the forefront of technological advancements in education.

7 Day Faculty Development Programme on Qualitative Research Methodologies

Date: 11 December 2023

The Department of Professional Accounting and Finance organized a Faculty Development Programme titled “QUALITATIVE RESEARCH METHODOLOGIES” from 11/12/2023 to 16/11/2023 through online mode. The objective of this Faculty Development Programme was to enlighten the educators seeking to delve into the significant realms of qualitative research. This programme has provided the participants with a comprehensive understanding of qualitative research methodologies. The educators and researchers were engaged in expert-led sessions, interactive discussions, exploring the significance and practical applications of qualitative research. The programme not only aimed at enriching participants' theoretical knowledge but also fostered a collaborative environment for networking and knowledge exchange. Embarking on the intellectual journey, the FDP promised to be a transformative experience, equipping faculty members with the tools and insights necessary to navigate the evolving landscape of qualitative research in academia.

Workshop On Outcome-Based Education

Date: 07 January 2023

The Department of Professional Accounting & Finance conducted a workshop on Outcome-Based Education and the calculation as well as the measurement of Outcomes. The workshop was conducted by Dr. Gokilavani S.

The session was conducted on the 7th of January 2023 at the M2 Auditorium, Main Block from 9:00 am to 10:00 a.m. The workshop was highly informative as the session entails lays emphasis on the clearly articulated idea of what students are expected to know and be able to do, that is, what skills and knowledge they need to have when they leave the campus. Outcomes are defined at three levels program outcomes (POs), program-specific outcomes (PSOs), and course outcomes (COs). The most important aspect of an outcome is that it should be observable and measurable.

The attainment levels of the courses and Programmes and the significance levels were also discussed. The workshop was informative and useful.

FDP on Personal Finance and Tax Planning

Date: 05/12/2022 to 10/12/2022

The Department of Professional Accounting and Finance, Kristu Jayanti College, has organized “One Week Virtual Faculty Development Programme on Personal Finance and Tax Planning from 05/12/2022 to 10/12/2022 from 5.30 pm to 6.30 pm through the zoom platform.

The faculty members and students from the college have participated in the programme. The resource persons were Mr. Suresh Kumar Mani, CA, CPA, Accounting Director, APAC, C.G.Systems International, Mr. Kamal Vora Rajnikant, CPA Instructor, Miles Education Bengaluru, Ms.Rajyashree Sharma, CA, CPA, Instructor, Miles Education Bengaluru, Ms.Neethu S Thottammariyil, IRS, Deputy Director, Training, National Academy of Direct Taxes, Regional Campus Bengaluru as well as Mrs.T.N. Srividya, Income Tax Officer, Ministerial Training Institute Bengaluru.

The resource persons enriched the knowledge of the participants, academic researcher, students and teaching community and shared their expertise on matters concerning tax. The basic concepts of direct tax were discussed followed by various tax planning saving schemes. The e-filing or returns procedures and the details pertaining to tax administration were also discussed during the sessions. What happens after one file a return conveying the assessment procedure, Search and Seize provisions of the Income Tax Act were also introduced at the session.

The perspective of the Income Tax Authorities on assessment procedures and the approach followed in tracking the tax evaders were also discussed during the session.

The session provided a great opportunity for the participants to learn and acquaint themselves with the practical aspects of the Income Tax Department. The session was well appreciated by the participants.

Course Plan And Lms Presentations

Date: 25 July 2022

A course plan is an essential ingredient of designing the delivery of the content in alignment with the objectives and desired outcomes of the course. The three primary components of a course plan are the learning objectives, assessments and instructional strategies. The plan entails a birds’ view on the course contents, objectives, outcomes, teaching pedagogy, skill enhancement activities, blueprint of the summative assessment and the references list.

The course plan assists in the initial vision and scope of a course before actually embarking on the design and development. A learning management system (LMS) is a software application for the administration, documentation, tracking, reporting, automation, and delivery of courses. LMS act as a repository for subject related content and give room for asynchronous and synchronous activities. The LMS acts as a reservoir and goes hand in hand with teaching and managing the learning needs of the learners.

With the onset of the new academic year, Course plan as well as LMS presentations were made by the faculty members to chalk out the plan for effective content delivery and attaining the course outcomes alongside a holistic approach to prepare the learners for the competitive world.

Role of Teachers in Enhancing Academic and Administrative Excellence

Date: 23-30 November 2021

The Department of Professional Accounting and Finance organised an In-house FDP on Role of Teachers in Enhancing Academic and Administrative Excellence. Seven Sessions were conducted from 23/11/2021 to 30/11/2021 and all the 17 faculty members of the Department attended the sessions. The objective of this FDP was to enrich the faculty members on the various roles played by the teachers both in academics and administration process.

Dr. Gokilavani. S, 2. Dr. Saranya. S, Dr. Reenu Mohan, Dr. Annie Stephen FCA, Prof. Aasha,

Dr. Kiran Kumar and Prof. Lourdanathan. F were the Resource persons for the sessions.

Overview on Programme outcomes and Course outcomes, Blended Learning Platform, Teaching Pedagogy, Documentation Process, E- Governance, Examination and Evaluation Process and Role of Teachers in inculcating Human Values and Ethics among students were discussed during these seven days in house FDP sessions. The outcome of this FDP was faculty members understood and realized that excellence can be attained by performing various roles as a teacher both in the teaching as well as administrative work.

Orientation on “Academic Aptitude Assessment”

Date: 29 October 2021

Department of Professional Accounting and Finance organized an orientation talk on “Academic Aptitude Assessment” on 29th October 2021 at 10.00 am in Conference Hall 1. Dr. Manikandan Kathirvel, Assistant Professor, Department of Life Science and Member was the resource person. The programme was organized for the faculty members of the Department of Professional Accounting and Finance.

The main focus of the discussion was the need and importance of assessing the learning levels of students. The students can be assessed formally and informally to determine their current knowledge level. Dr. Manikandan stated that a teacher needs to identify the strengths and weaknesses of the student and develop their talents through various activities. To identify and assess the learners the college has developed a strategy called AAA. Under this strategy the assessments will be conducted three times in a semester viz., pre-course, midcourse and post course assessment. Dr. Manikandan explained about the activities that may be conducted by the teachers to engage the slow learners and advanced learners. The session concluded with an open discussion wherein the queries raised by faculty members were clarified by the resource person.

Orientation on “Outcome Based Education”

Date: 28 October 2021

Department of Professional Accounting and Finance organized an orientation talk on “Outcome Based Education” on 28th October 2021 at 10.30 am in Pane Room II. Dr. Aloysius Edward, Dean, Faculty of Commerce and Management was the resource person. The programme was organized for the faculty members of the Department of Professional Accounting and Finance.

The main focus of the discussion was the need and importance of Outcome Based Education in preparing the students procure necessary attributes and skills required to obtain a career. Each programme has a programme outcome and porgramme specific outcome which are based on domain related skills and domain unrelated skills. Dr. Aloysius Edward explained the OBE policy of the college by giving an overview of the concept “Attainment Level” specific to the course and programme. The session concluded with an open discussion wherein the queries raised by faculty members were clarified by the resource person.