Peer Learning

Peer Teaching

Date: 04 September 2023

The Department of Professional Accounting and Finance orchestrated a dedicated session titled "Peer Teaching" for third-semester ACCA students. The session featured Mr. Nitesh Aditya V, student at Kristu Jayanti College Autonomous, Bengaluru.

This peer teaching session was conducted on September 4th, 2023. Mr. Nitesh focused his discussion on the Financial Reporting subject, offering valuable insights into approaching and handling ACCA exams effectively. He also provided students with a fundamental framework for comprehending the subject and emphasized the significance of establishing a solid foundation in Financial Reporting to facilitate smoother ACCA paper navigation.

Towards the conclusion of the session, he actively engaged with students, addressing their questions and concerns regarding ACCA examinations, and shared strategies for achieving success with confidence. The session proved to be highly informative, offering a plethora of practical tips for students to incorporate into their ACCA journey, paving the way for a clearer path to success.

Income Tax Raid

Date: 19 April 2023

Income tax raids are conducted by tax authorities to investigate potential tax evasion and unaccounted wealth. They involve a surprise search and seizure operation at the premises of an individual, business, or organization suspected of underreporting income or not complying with tax laws. During a raid, tax officials gather evidence, including financial documents, cash, valuables, and electronic records. These operations are carried out under strict legal procedures and require proper authorization from senior tax officials or the judiciary. The presenter made a presentation on the Income tax raid conducted in the premises of BBC. The presenter also shared insights on Income tax Inspections and the procedures involved while conducting a Raid. The procedure of search and seizure were also shared. The session was interesting and paved the way for interaction and discussions.

Benami Deals

Date: 19 April 2023

The presenter introduced the topic of Benami Deals to the students and shared few cases on Benami Deals. "Benami deals" refer to transactions where property or assets are held in the name of a third party, often to conceal the real owner's identity. The Surat Case was cited with an allegation of “benami deals" worth of approximately Rs 1,700 crore. Land and business documents revealing benami deals worth Rs 1,700 crore were seized during the raids that uncovered the benami deals between the diamond firms and the real-estate market. The presenter also shared insights on Bhavna Gems case. The company maintained the benami records at a small electrical shop opposite their factory in Katargam. The officials have seized records from the past 15 years to 17 years from both firms. The session was interesting and intereactive.

SDGs

Date: 17 February 2023

The Sustainable Development Goals (SDGs) represent a global blueprint for addressing the most pressing challenges facing our planet, encompassing issues related to poverty, inequality, environmental sustainability, and social well-being. These 17 interlinked goals, adopted by all United Nations Member States in 2015, aim to create a more just and equitable world by 2030. By targeting issues such as poverty, hunger, education, healthcare, and environmental preservation, the SDGs provide a comprehensive framework for governments, organizations, and individuals to collaborate on building a more sustainable and inclusive future for all. Achieving the SDGs requires collective action, innovation, and a commitment to leaving no one behind, making them a cornerstone of global efforts to create a better world for current and future generations. The presenter spoke on the role each one has to play in the development of the nation and being part of the SDG.

Filing Income Tax Return

Date: 8 February 2023

Filing an income tax return is a fundamental responsibility for individuals and businesses in many countries. It involves the annual submission of financial information to the tax authorities, reporting all sources of income, deductions, and credits to determine the amount of tax owed or any potential refunds. Filing a tax return not only ensures compliance with tax laws but also offers the opportunity to optimize one's financial situation. Taxpayers must file their returns accurately and on time, typically by a specified deadline. While the process can be straightforward for some, it can be complex for others with diverse income sources or deductions. Seeking assistance from tax professionals or using tax preparation software is common to ensure a smooth and compliant filing process. Ultimately, filing an income tax return is a critical financial task that helps fund public services and social programs while also allowing taxpayers to manage their tax liabilities effectively.

Therefore the presenter shared the procedure of filing returns , dates of filing returns and the consequences of not filing the returns. The session was informative.

AI and Business Analytics

Date: 8 February 2023

In the dynamic landscape of modern business, data is often considered the new currency. Companies generate vast amounts of information daily, from customer interactions and sales figures to supply chain operations and marketing campaigns. The challenge lies in harnessing this data to make informed decisions that drive growth and competitiveness. This is where the fusion of Artificial Intelligence (AI) and Business Analytics becomes a game-changer. AI, with its ability to mimic human intelligence, is a powerful tool in the realm of Business Analytics. It enhances the process of collecting, processing, and analyzing data in various ways including Data Processing, Predictive Analysis, Real Time Analysis, Anomaly Detection and NLP. The presenter shared insights on the future of AI and its role in business analytics. The presenter also shared the synergy between AI and Business Analytics and the way businesses leverage data for competitive advantage and how the integration of AI technologies into the analytics process empowers organizations to make data-driven decisions with greater accuracy, efficiency, and speed. The session was interactive and engaging.

Stock Trading

Date: 27 January 2023

Fintech, the convergence of finance and technology, is revolutionizing the financial industry. Fintech companies utilize innovative digital solutions to offer a wide range of financial services and products, from mobile payment apps and online lending platforms to blockchain-based cryptocurrencies. This disruption is increasing financial inclusivity, making services more accessible and affordable, and streamlining traditional processes. As fintech continues to evolve, it has the potential to transform how we save, invest, transact, and manage our money, creating a more interconnected and technologically-driven financial landscape. The speaker spoke on the future of Fintech in India and also the challenges that could surface in the years to come. He presenter also shared the careers offered with Fintech. The session was insightful.

Building Competencies

Date: 27 January 2023

In today's competitive world, a diverse set of skills is essential to thrive and excel in both personal and professional pursuits. Academic achievements alone are no longer sufficient; individuals need a combination of soft and hard skills to stand out. Communication skills, critical thinking, adaptability, and problem-solving abilities are crucial for navigating the complexities of the modern workplace. Furthermore, digital literacy and technology proficiency have become indispensable in an increasingly digitalized world. Emotional intelligence, teamwork, and cultural sensitivity are equally important in fostering positive working relationships and global collaboration. Continuous learning and self-improvement are vital in this ever-evolving landscape, making lifelong learning a valuable skill in itself. In essence, the ability to cultivate and apply a wide range of skills is the key to success and competitiveness in today's dynamic and challenging environment.

The presenter shared few tips to ace in the corporate world and the need to be competitive. He also shared information on few online certification courses that will give an edge to the students as they transition from campus to corporate.

Jet Airways

Date: 27 January 2023

The presenter shared information on the genesis and the challenges grappling the Airways.

Jet Airways, once a leading player in India's aviation industry, faced a multitude of challenges that eventually led to its suspension of operations in April 2019. The airline grappled with a severe financial crisis, driven by a combination of factors including high operating costs, intense competition, fluctuating fuel prices, and a substantial debt burden. Management issues, labor disputes, and regulatory hurdles further compounded the problems. Jet Airways' inability to secure adequate funding for its day-to-day operations and expansion plans became a critical issue, resulting in grounded flights and a significant loss of passenger trust. With its distinctive tailfin design and a reputation for quality service, Jet Airways gained a loyal customer base. However, the airline faced significant financial challenges and operational issues in the last decade, leading to its suspension of operations in April 2019. Despite these setbacks, Jet Airways remains a recognizable brand and has made efforts to revive its operations. Its legacy and historical significance in Indian aviation have left a mark, and its potential return to the skies is closely watched by industry observers and travelers alike.

Stock Trading

Date: 27 January 2023

Stock trading is the practice of buying and selling shares or ownership stakes in publicly traded companies within financial markets. It is a fundamental component of the global economy and a vital mechanism for capital formation. Investors, ranging from individual traders to large institutional investors, engage in stock trading for various reasons, including wealth accumulation, portfolio diversification, and speculation. It is influenced by a myriad of factors, such as economic data, corporate earnings, geopolitical events, and market sentiment. Stock trading carries both opportunities and risks, and successful traders often conduct thorough research and analysis to make informed decisions. One must remember that stock trading involves risks, and there are no guarantees of profits. It's essential to approach trading with a long-term perspective and a focus on prudent risk management to increase your chances of success. The presenter shared tips on stock trading which included educating oneself, watching the market movements, creating a trading plan, diversification of portfolio, risk management and staying informed.

Peer Learning Session on “Preparation for CMA Exam”

Date: 10 February 2023

The Department of Professional Accounting and Finance organised a peer learning session on 10th February, for the second year B.Com CMA students. The students were addressed by the final year students Mr.Aldrin Saijan who cleared part 2 of the CMA Exam and Ms. Aneena Telson P, who cleared part 1 of the CMA exam in their first attempt itself. The main objective of the session was to provide the CMA students with detailed guidelines on preparing for a highly competitive professional exam such as CMA.

Mr.Aldrin explained the importance of spending some amount of time on a daily basis, in order to clear the paper. Ms. Aneena explained the various sources of study materials available including online platforms for conceptual clarity. They shared their ideas and views on how to clear the CMA exam and also shared their experiences and challenges they faced during the preparation. They encouraged the students to prepare for the exam with a clear vision and focus. The speakers explained the importance of solving at least twenty questions daily so that they can complete a major portion of the practice questions. Mr. Aldrin emphasised the significance of making the theoretical concepts clear and this will be useful when appearing for the essay section. They also encouraged the students to resources and content on Google such as study videos and reference materials.

The session concluded with an open discussion wherein Mr.Aldrin and Ms.Aneena clarified the doubts and queries raised by the students and thereby making the session interactive and informative. They also encouraged the students to attempt the CMA exam and assured them that it is highly achievable if the students are willing to pay the price.

Peer Learning Session on “Preparation For Cma Exam”

Date: 22/09/2022

The Department of Professional Accounting and Finance organised a peer learning session on 22nd September, 2022 from 10am to 11.00 am for the second year B.Com CMA students. The session was conducted by Mr. Aaron Joseph Thomas, student of final year B.Com P4 who completed part1 of CMA Exam in the first attempt. The main objective of the session was to provide the students detailed guidelines on preparing for a highly competitive professional exam such as CMA.

Mr. Aaron shared his ideas and views on how to clear CMA exam and also shared his experiences and challenges he faced during the preparation. He encouraged the students to prepare for the exam with a clear vision and focus. The speaker explained the importance of daily practice of questions, increasing the pace of solving the problems and also the need to have a time frame of preparation. Mr. Aaron suggested various platforms like google, YouTube where the students can access more relevant information related to their exam.

The session concluded with an open discussion wherein Mr. Aaron clarified the doubts and queries raised by the students and thereby made the session interactive and informative.

Student Seminar New Technology Developed by ISRO Called the Inflatable Aerodynamic Decelerator (IAD)

Date: 19 September 2022

Kevin Cherian, student, V B. COM P3 took over a session on ISRO new technology that can be used for Mars, Venus Missions. 54 students from V B.Com P3 participated in this session.

ISRO successfully demonstrated a new technology with Inflatable Aerodynamic Decelerator (IAD) which was a game-changer with multiple applications for future missions. An IAD was designed and developed by ISRO’s Vikram Sarabhai Space Centre (VSSC), was successfully test flown in a ‘Rohini’ sounding rocket from Thumba Equatorial Rocket Launching Station (TERLS). The IAD was initially folded and kept inside the payload bay of the rocket, according to the Indian Space Research Organisation (ISRO), Bengaluru. At around 84 km altitude, the IAD was inflated and it descended through the atmosphere with the payload part of sounding rocket. The system for inflation was developed by ISRO’s Liquid Propulsion Systems Centre (LPSC). The IAD has systematically reduced the velocity of the payload through aerodynamic drag and followed the predicted trajectory. ISRO further reported that new IAD elements like micro video imaging system which captured the bloom and flight of IAD, a miniature software-defined radio telemetry transmitter, MEMS (Micro-electromechanical systems)-based acoustic sensor and a host of new methodologies were flight tested successfully. The session was informative.

Student Presentation on Mega Rail Project

Date: 10 September 2022

Abdullah, a student of Vth semester BCom P3 did a presentation on Silver Line Project on 10-09-2022.Around 75 students participated in the session. The speaker shared his thoughts on the mega rail project of Kerala which is the Silver Line project in association with the Kerala Government and the Central Government.

The Silver Line which is a proposed higher speed line line in India that would connect Thiruvananthapuram, the capital city, and Kasaragod of Kerala state would have an operating speed of 200 kilometres per hour (120 mph), [Maximum Design Speed: 220 kmph (55 mps), (structures designed for 250 kmph (69.5 mps))] allowing trains to cover the 532-kilometre (331 mi) distance in less than four hours, compared to the present 10 to 12 hours it takes to traverse this distance. It was a very informative session as the speaker shared a detail information about the project Outline, Background and its impact on the environment.

Student Presentation on Sri Lankan Crisis

Date: 06 September 2022

Aman Sharma, a student of Vth semester B Com P3(2020 Batch) presented on the Sri Lanka crisis on 06-09-2022. 75 B Com students participated in the session. The speaker shared information about the devastating crisis in Sri Lanka and the impact of the same on the nation. He also added that the Sri Lanka’ s economic crisis was driving millions of people into poverty, jeopardizing their rights to health, education, and an adequate standard of living, Human Rights. The United Nations had estimated that 5.7 million people in Sri Lanka need humanitarian assistance, with 4.9 million – 22 percent of the population – being food insecure, meaning they do not have consistent access to adequate, nutritious food. Families were already struggling from the pandemic, with 36 percent reporting reducing their food consumption in a UNICEF survey in late 2020. That number doubled to 70 percent, just as the economic crisis hit. The speaker also shared his opinion on the causes for such crisis and ways to resolve it. It was an informative session as the speaker shared his insights on the various aspects of the Sri Lankan crisis.

Discussion On Agricultural Income on Agricultural Income

Date: 02 September 2022

Firmly ensconced in this category is the notion that the Indian farmer is the annadata whose sweat and tears feed 1.4 billion Indians? Since agriculture income doesn’t attract income tax, virtually every rich Indian becomes a ‘farmer’. Note how income attributable to a ‘farmhouse’ is exempt from income tax provisions. Millions of rich Indians- politicians, entrepreneurs, film and sports stars, lawyers, doctors, architects, chartered accountants-have all become annadatas because of this “deliberately” placed loophole in the rules. There has never been a reliable or reasonably accurate study and estimate of how much income in India escapes the tax dragnet because of this annadata fixation.In such a scenario, even a suggestion that Section 10(1) of the Income Tax Act, 1961 be abolished would sound like a double dose of heresy and blasphemy.

Jaise Mathew, a student of Vth semester B Com P3 therefore initiated a debate on the topic agricultural income and whether the same should be exempted from tax. The students participated in an intelligent exchange of views and ideas. He session was thought provoking.

Peer Learning on Indirect Tax

Date: 26 August 2022

Shashank R, a student of Vth semester B Com P3 (2020 batch) engaged in Peer Teaching for the batch of Final Year P3 students. The speaker shared his insights on GST - Goods and service tax. The speaker shared a brief history of GST, benefits of GST and how GST was administered in India. He also discussed the rates of GST. He also shared an outline of the GST Council- Constitution, Functions and Decision-making.

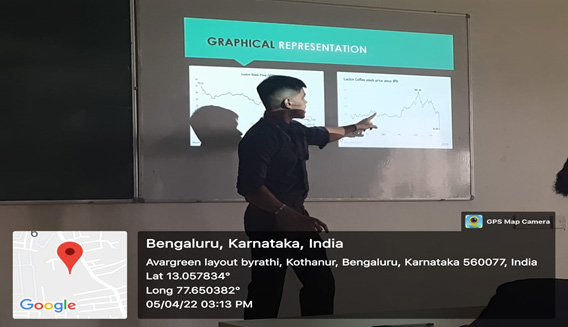

: Movement of Stock Prices

Date: 25/10/2022

A session on the Movement of Stock Prices was conducted by the student Ajith from B.Com BA P2. 66 students from V Sem. B Com P2 attended the session. The objective of the session was to create awareness among the students regarding the stock price movements and the factors affecting the same. The speaker discussed the highs and lows of the stock market and the factors affecting the upward and downward movement of prices. The speaker shared inputs on how to invest in stock markets and what to invest in. The market live updates were also presented and the details of the most active stocks were shared.

Deductions Under Section 80

Date: 05/05/2022

A presentation on Deduction under 80C was delivered by Maria Shalini A from B.Com (BA) P2 in order to give a Brief Introduction to Deductions that can be claimed from Gross Total Income. The speaker shared information on Sections 80 C, 80 D , 80 DD. 80TTE, 80 RRB, 80 U, 80 QQB and 80 G.

75 students from B.com (BA) P2 have attended the session. The session was informative and well appreciated by the students.

Elon Musk Buys Twitter for $ 44 Billion: Tesla Boss or Darag Agrawal Who Will Run Twitter

Date: 28/04/2022

Nagashree G S, from B.Com P2 shared insights on Elon Musk buyout of Twitter for $ 44 billion. The objective of the discussion was to draw out the strategies of Elon Musk on buying the most popular Social- Media called Twitter. Tesla CEO, who is also the world’s wealthiest person, wanted to buy and privatize Twitter because he thinks it’s not living up to its potential as a platform for free speech.

Musk wished to make the service “better than ever” with new features, such as getting rid of automated “spam bots” and making its algorithms open to the public to increase trust. The participants had an open discussion on Elon Musk’s strategies that drive him to pursue big.

The session was interactive and informative.

Inspirational story about Muniba Mazari the "IRON LADY OF PAKISTAN"

Date: 27/04/2022

An inspirational story was shared by Narmada Sadan P from B Com BA P2 in order to create a never giving up attitude among all, achieve their goals no matter what obstacles they face in life. 66 students from V P2 participated in the event. The story was connected to a women who was badly injured and got paralyzed after a fatal accident and her husband also too divorced her due to her inability to deliver a baby. But she did not give up and worked hard despite her inabilities and came to be known as the Iron Lady of Pakistan. She is Muniba Mazari who is a Pakistani activist, anchor artist, model, singer and motivational speaker. She became the National Ambassador for UN Women Pakistan after being shortlisted in the 100 Inspirational Women of 2015 by BBC. She also made it to the Forbes 30 under 30 list for 2016.

The session was motivational and inspiring.

Leadership Skills for Workplace

Date: 11.04.2022

A session on Leadership Skills for the workplace was conducted by student Neethu Akshara from B.Com BA P2 on the current political crises in Pakistan as Pakistan's Prime Minister Imran Khan was ousted from power after losing a no - confidence vote. She also shared insights on the skills required for workplace success. They included Communication skills, Strategic & Critical Thinking, Interpersonal Communication, Authenticity & Self-Awareness, Open-Mindedness & Creativity, Flexibility and the ability to adapt. She shared the inspirational stories of a few leaders who have made it big by their dedication, foresight and hard work. The session was interesting and inspiring.

Student Presentations Academic Year 2021-22

Date: 08.04.2022

Dealing with risks associated with fraud is on no bank’s wish list, but it is a fact – frauds are on the rise and will continue to rise, especially within the current business environment. While there is no doubt that banks are making investments to enhance their fraud risk management framework, monitoring systems and controls, however it appears that these efforts have not been sufficient. Gowri A S from B. Com ACCA presented on banking scandals. The aim of this session was to bring in awareness about banking frauds and its effects. This session was a brief presentation about India’s biggest bank fraud- ABG Shipyard Case which was declared India’s biggest bank fraud surpassing all other cases. The session was very much interactive and informative.

Student Presentation

Date: 07.04.2022

Prabhu V presenting an inspirational story of a college dropout.

A presentation was conducted Prabhu.V student of B.com (BA) P2 on the Inspirational Story of College Dropout-Ashish Raj. The main objective of the presentation was to inspire students to do well in all their pursuits. Ashish Raj, hailing from Munger, Bihar managed to get past the life of a driver where he used to pick and drop people from the airport and is currently working as a software engineer at WebEngage. The speaker gave a brief of his background stating that he was the son of a farmer and Ashish’s family is not financially well-off. After finishing school, he moved to Bhopal, Madhya Pradesh, for further education. His father spent his life savings for Ashish’s first year fee in college. Ashish took up a diploma in electrical engineering upon advice from friends and family, hoping that he would land a job in the government sector. But he was struggling to make his ends meet while in Bhopal. This is when Ashish stumbled upon a short-term (30-week) course in full-stack web development at Masai. He took the course in April 2020 and learned HTML, CSS, Javascript along with the MERN stack. He also built a clone of the professional networking website LinkedIn as part of his project work. After the course he got a job at WebEngage. His dreams don’t end here and he is on the quest for more. Never give up is the message that he would like people to learn from his own experiences. The session was interactive and beneficial for the students.

Student Presentations Academic Year 2021-22

Date: 07.04.2022

Money laundering is a financial crime that relies on stealth and flying under the radar. Understandably, detection poses a significant challenge in this field. Money laundering legislation have been created and implemented in countries all over the globe, and global organisations such as the United Nations Office on Drugs and Crime (UNODC) and the Financial Action Task Force (FATF) regulate the global banking industry’s activities. Yet money laundering remains a threat and a phenomenon that is hard to track. Despite its incognito nature, there are some statistical insights available on this global crime that costs the world around USD 2 trillion every year. A session on Money Laundering was conducted by Bhavaya Nagar from VI Semester B.COM ACCA. The presenter spoke about the Banking giant HSBC which was fined £63.9m by the UK's financial regulator for "unacceptable failings" of its anti-money laundering systems. The speaker also covered some important aspects of the case including Introduction about HSBC Bank, Charges against HSBC money laundering case 2012, new era for HSBC bank, Anti-money laundering system and the shutdown of the case. The session was informative and interactive.

Deductions from Gross Total Income

Date: 06.04.2022

An informative session was taken over by Priyanka Yadav student of B.COM BA P2 on the topic Deductions from Gross Total Income in order to create awareness on deductions from Gross Total Income. 65 students from VI Sem BCom P2 attended the session. The speaker explained the New tax rules for the financial year 2022-2023, and also shared tips on ways and means to avoid paying taxes to the government. The procedure for e-filing of returns, advance tax, TAN, PAN and the consequences of not paying taxes to the government were also shared by the speaker. The session was very much informative and well appreciated by the students.

INTRODUCTION TO NFTs

Date: 01/04/2022

Non-fungible tokens are the latest hype train in the block chain world. They’re still very much in their infancy stage, but they’re beginning to showcase themselves as incredibly useful tools for promoting the ownership and the authenticity of all assets. A session on Non Fungible Tokens was conducted by student Raghu from from Vl Sem B.Com P2 in order to make the participants aware of the concepts of Non Fungible Tokens (NFTs). The session begins with the speaker giving the meaning of NFT and how they work and the best NFT’s to invest in. The session was concluded by taking a glance at the most popular and costliest NFTs which were sold in the previous year (2021). The session was highly informative and interactive.

Russia India Oil Trade and the Taiwan Unrest

Date: 25/03/2022

A session on Business News was conducted by Ritesh Krishnan R. student of VI Sem BCom P2. The speaker started the session with the recent popular news in India. Few important business news covered were about the Indian Government move on Tourist Visa as Multiple Entry Tourist Visa granted for a period of 10 years to the nationals of USA, Canada and Japan with a stipulation that “continuous stay during each visit shall not exceed 180 days and registration not required.

He also shared news about the Former Amazon India Director Vijay Subramanian starting a new independent venture, where TATA to set foot in third party payment and about the oil trade between India and Russia as Major oil importing countries such as India and China have been grappling with higher crude prices, which have been soaring. He session concluded with a Q&A. The session was informative.

Inspirational Success Story of Manof Aggarwal

Date: 25/03/2022

Sadhana of BCom P2 sharing her thoughts on the Best Apps available for students to apply for jobs

An issue that plagues the lives of most students when they graduate is finding a job. After spending several years studying and carefully selecting ones majors, students, naturally, want to be able to get a good job that meets their needs. These requirements can be related to the industry they will eventually work in, the salary and compensation they will receive and the kinds of flexibility they will get in terms of timings.

Going down the traditional route of job hunting can be a tedious and cumbersome task — many recent graduates often struggle with having to send their CVs to several employers and never hearing back from them. Months are often spent tracking down good jobs through ones networks or university career fairs, often to no avail.

A session was conducted by Sadhana of B.Com P2 in order to create awareness on search engines for jobs and higher studies abroad. With the advent of websites and applications, the process of job hunting has become several times easier. By simply downloading an app to one’s phone, and with the touch of just a few buttons, students are able to find jobs in no time! In fact, surveys have found that 78% of Millennials used their mobile devices to find jobs as of 2016 and these figures are on an upward trajectory. She also shared information on the various appas that could be downloaded for jobseekers.

CEUT (Common University Entrance Test)

Date: 23/03/2021

A session on Common Entrance Tests that can be taken after or while graduation was brought forth by Ms. Rakshita a student from B. Com Business Analytics P2 VI. The main objective of the session was to make the students aware of the various options available to the students for higher studies.

Speaker covered details of entrance exams such as A Common Proficiency Test(CPT)Institute of Chartered Accountants in India (ICAI), St Xavier Entrance Test, Company Secretary Executive Entrance Exam (CSEET), Institute of Company Secretaries in India (ICSI)

NMIMS – NPAT Narsee Monjee Institute of Management Studies (NMIMS), SET Symbiosis University, DU JAT National Testing Agency, IPMAT-Indian Institute of Management Indore,ACET IAI (Institute of Actuaries of India).

Investment Opportunities- The Shark Tank Way

Date: 11/03/2021

Mr. Isaac Stalin, student, VI B. COM P2 took over a session on Investment Opportunities- The Shark Tank Way. 72 students from V Sem. B Com P2 participated in the session. The speaker shared insights on the SHART Tank Show and how the programmer enlightened the viewer on new innovative ideas and the views expressed by the Sharks on Business Plan presentations. "Shark Tank" is a popular show on which investors (or Sharks) hear pitches from business owners who want funding from them. The show features a panel of investors called "sharks," who decide whether to invest as entrepreneurs make business presentations on their company or product. The sharks often find weaknesses and faults in an entrepreneur's product, business model or valuation of their company. The session concluded with playing a video of one of the popular Shark Tank session. The session would be helpful for preparing effective and workable Business Plan Presentations in the corporate world and to the budding entrepreneurs. The session was interactive and informative.

Risk and Return Analysis of Investments

Date: 10/03/2021

Mr Mohammed Muzammil of V Sem B.Com P2 took over the session on risk and return analysis of investments. The speaker highlighted the investment avenues and also the risks and returns associated with each form of investment. Statistical data was presented to explain the risks and returns associated with each investment using five year data.

The session was well appreciated by all the participants.

Russia-Ukraine War Face a New Tug of War in India

Date: 09/03/2021

The most intense battles in Ukraine are still taking place in the east, but fighting has been picking up in the north and south of the country as well. Ukraine's military says it carried out strikes against Russian positions on Snake Island, an outpost in the Black Sea, suggesting the use of longer-range weapons recently provided by Western countries. A session on Russia-Ukraine war face a new tug of war in India conducted by Sandesh, student of VI BCOM P2. 75 students from B.Com (BA) P2 participated in the session. The objective of this session was to enlighten the students about the plight of the Indian students in Ukraine. The speaker described that despite being enrolled in various educational institutions for undergraduate medical education in Ukraine, thousands of students had to leave their studies midway and return to India. Some students also participated in the discussion and shared their views on Russia and Ukraine standoff.

10 Iconic Quotes by Shane Warne that Will Inspire Generations

Date: 07/03/2021

A motivational session was conducted by the Mohammed Arbaz student of B.Com BA P2 on the topic- 10 Iconic Quotes By Shane Warne That Will Inspire Generations. The speaker shared the life of Shane Warne Australia's Shane Warne, one of cricket's all-time greats, who had tragically passed away of a suspected heart attack at the age of 52 in Koh Samui, Thailand. The session concluded with a moment of silence observed for the departed soul. 66 students from V Sem B.Com P2 participated in the session. The session concluded with a moment of silence observed for the departed soul. The objective of the session was to motivate to the students with the life story and struggle of the famous Australian Cricket Shane Warne.

Student Presentation

Date: 07/03/2021

A session was conducted by the student Navyashree from VI BCom P2 (2019 Batch). The major topics of the discussion was the Karnataka SI Selection process. Speaker shared that Karnataka State Police Department (KSP) has recently announced its Karnataka Si selection process for the 402 vacancies of Sub-inspector. The candidate has to qualify in both - Endurance Test/Physical Standard Test (ET/PST) and Written Exam to be selected for the Karnataka SI post. The ET/PST requirements for male and female candidates were also shared.

In the case of the written exam, there are two papers - Paper-I and Paper-II for 50 marks and 150 marks respectively. Paper-I is of the descriptive type where the candidate must clearly prove his/her English comprehension and writing skills. Then, the candidate has to solve paper-II which has objective-type questions on Mental Ability and Current Affairs. The session was very informative and useful.

Student Presentations Academic Year 2021-22

Date: 04/03/2022

A session was conducted by Abhishek K from VI B.COM P2 on the impact of crude oil prices due to Russia and Ukraine war. The main objective of this session was to bring in awareness on the effect of prices of crude oil due to Russia invasion on Ukraine. The speaker started with a brief background of the Russia – Ukraine war and over the loss of Russia's power and influence since the break-up of the Soviet Union in 1991 and the rise of the Crude oil prices during the build-up of Russia’s President Vladimir Putin’s special military operation in the Soviet-era constituent, Ukraine, backed externally by the US-dominated military alliance called NATO (North Atlantic Treaty Organization). The session was a thought provoking session and captured the attention of the students.

Student Presentations Academic Year 2021-22

Date: 04.02.2022

Accounting scandals have been on the rise and it necessitates the learners to be aware of the scandals and the impact of the same on the economy.A session on Accounting Scandal that took place in Luckin Coffee 2022 was conducted by the student Monish.S from BCom ACCA. The session covered the Introduction about Luckin Coffee, Founders and the Accounting Scandal that took place 2020. The presenter also threw light on the adoption of new chairman, Re-structuring of Luckin Coffee, and the scandal in depth. The session was informative and interactive.

Collaborative Learning Session for CA and CS Aspirants

Date: 04/02/2022

The Department of Professional Accounting and Finance, Kristu Jayanti College (Autonomous), organized Collaborative learning session on 4th February 2022 for first year CA and CS aspirants. The speakers were Mr Manoj Kumar, Mr Vinay C and Ms Vasundhara B K from VI Semester BCOM P1. The speakers gave an introduction of the professional courses – CA and CS and the career prospects. They discussed on various aspects like registration, examination, subjects to be prepared, online resources for various subjects. It proved to be a very informative session as the participants were able to clarify their doubts. The speakers urged the students to maintain a healthy study life balance.

Motivational Session on Breakthrough Towards Excellence

Date: 28/10/2021

Classes Attended & Number of beneficiaries: 50 students, III Sem B. Com P1

Objective: To enlighten the students on the importance of CA/CS courses and the ways of clearing CA foundations and CSEET.

It is a well-known fact that CA/CS exams are difficult to clear and the pass percentage of the number of students who cleared CA foundations or CSEET is considerably low and the dropout rate keeps increasing and many students aren’t registering themselves for further attempts. In this regard, a motivational session was conducted by the students of V BCOM P1 for their juniors i.e., III BCOM P1.

The speakers addressed the students on the importance of clearing the professional examination and encouraged them to continue their journey in the professional course. They also emphasised on subjects such as problem solving, systematic approach, time management and self-care.

The following are the agendas that were covered in the session:

• How to crack the foundation papers.

• Various portals, from which they can find Study material.

• Familiarizing the ICAI & ICSI portals to the students.

• Motivation and guidance from seniors.

• Sharing personal study experience of students who have cleared the professional exams.

• Importance of participating in different fests conducted by college and how it helps them in becoming a better professional.

• Clearing relevant queries related to the professional courses.

On Peer Learning on Most Commonly Used Terms In Income Tax

Date: 27-10-2021

The session involved explanation of 5 commonly used terms in Income tax which was conducted on 27/10/2021. The terms are as follows: Exemptions, Rebate, Deductions, Average rate of tax, and Marginal rate of tax. The session involved an explanation of all the 5 terms with suitable examples to clear the concepts. The concepts provide a clear understanding of jargons used in Income tax. Also, the understanding of them is important to understand various provisions and case laws related to income tax. The presenter also gave illustrations and brain storming activities to help students comprehend the terms with ease.

Peer Learning on the Topic “Meaning of Relative as Per Income Tax Act”

Date: 24/9/2021

Classes Attended & Number of beneficiaries: 65

Name and details of the Resource Person: Miss Vemula

Objective: To encourage learning through Peer involvement, encourage teach and learn and build team spirit and collaborative learning amongst the students

The student Vemula from BCom PI (Batch 2019-22) took up the topic “meaning of relative under the Income Tax Act” for discussion with the students. She gave a diagrammatic representation to explain the meaning of the term relative as per the Act. During the interaction, she also gave four illustrations for brain storming and give clarity to the concept discussed during the session. The students interacted well with the speaker and the main objective of students initiating and participating in the learning process was well achieved.