Faculty Development Programme

SAṂVIDHI '24: International Faculty Development Programme

Date: 06 to 14 November 2024

The Department of Economics successfully conducted SAṂVIDHI '24, an International Faculty Development Programme, from November 6 to November 14, 2024, focusing on "Advances in Social Science Research Tools, Techniques, and Trends." The event brought together educators and researchers worldwide to enhance their research skills in qualitative and quantitative methodologies. Participants explored emerging research tools such as AI, big data analytics, and social network analysis, guided by experts from leading academic institutions. A key focus was placed on the ethical implications of AI in social science research, emphasizing the responsible use of these technologies. The programme included hands-on training in Jamovi for data analysis and Zotero and EndNote for reference management, promoting academic integrity. It also fostered interdisciplinary collaboration, encouraging a more integrated approach to tackling global social issues. By the end of the programme, attendees had gained enhanced analytical skills and a deeper understanding of how to incorporate cutting-edge technologies into their research.

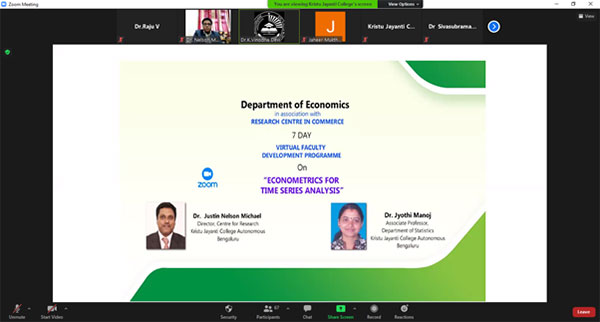

7 Day Virtual Faculty Development on “Econometrics for Time Series Analysis”

Date: 03-03/2021 to 10/03/2021

Platform: Zoom

Resource Persons: Dr.Nelson Justin Michael and Dr.Jyoti Manoj.

Number of beneficiaries’ attended Workshop: 300 (Students and faculty members of Department of Economics students and faculty members of Dept. of Commerce, 213 and external participants, 213+87).

Name of the Workshop: 7 Day Faculty Development Programme on “Econometrics for Time series Analysis"

The Department of Economics (PG), Kristu Jayanti College, has organized a 7 Day Faculty Development Programme on “Econometrics for Time series Analysis"from 03rd t to 10th of March 2021. The resource persons were Dr Justin Michael Nelson and Dr Jyoti Manoj. The FDP was started with inauguration ceremony by welcoming the Management, Resource persons, faculty members, delegates and the Students.

Day 1

It was started with topic “Cointegration and error correlation mechanism: concept of causality and followed by most important topics in econometrics.

Day 2

It was started with the topics like autoregressive models and modelling volatility. The participants to have an opportunity to learn a subject which is very much useful for the future and it was proud moment for the participants.

Day 3

It was started with the topic using heteroscedasticity, followed by ARCH&GARCH models, that was the last session taken by the resource persons; it was happy moment for the participant and exciting moment for the participants.

Day 4

It was started with topic “Stationary series in econometrics which is very helpful for analysis, most of the participants were research scholars, for them it was a knowledgeable session.

Day 5

It was started with topic “Multicollinearity, it was a great moment for the participants to have an opportunity to learn a subject with practical significance.

Day 6

It was started with topic “Cointegration concept of causality and followed by most important topics which is very helpful for data analysis, most of the participants were research scholars, who benefitted by this programme.

Day 7

It was started with topic “Gretl, arima, and other concepts in econometrics which is very helpful for research aspect.

Finally the 7 Day faculty Development Programme“on Econometrics for Time series Analysis" ended with vote of thanks.

International Faculty Interaction on Financial Market Stability & Economic Growth

Date: 04/01/2018

Number of beneficiaries: 8

List of Resource Persons with details:

Dr. Sheri Markose, Professor, School of Economics, University of Essex, UK and Founding Director, Centre for Computational Finance and Economic Agents (CCFEA), Essex

Objective: To understand the importance of financial market stability in fostering economic growth.

he session was started with a welcome address given by Shama Stephen, student, IV MA Economics followed by introduction of resource person. The interaction started with a brief introduction of the Centre for computational finance and economic agents followed by the importance of ICT in the financial market research. The resource person had given the example of the role of the financial sector in the Global recession of 2007-08 and highlighted the concepts of shadow banking and misleading measurement of risk. The resource person has stressed on the use of Simulation method and network method to analyze the present market situation. The students have interacted about the applicability of such methods in other related areas. The resource person also talked about systemic risk management as the need of the hour and interacted about the position of India in the Global Recession Scenario.