Guest Lectures

“Expert Insights on Tax and ITR Management: From Planning to Filing”

Date: 23 August 2024

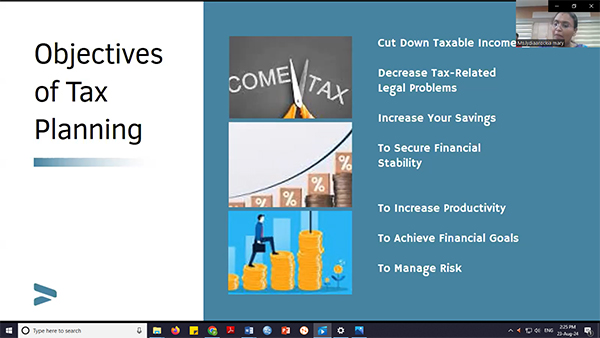

The Department of Commerce (PG) at Kristu Jayanti College successfully organized a workshop titled “Expert Insights on Tax and ITR Management: From Planning to Filing” on the 23rd of August, 2024. The virtual event, held via Zoom, provided participants with valuable knowledge and practical insights into tax planning and Income Tax Return (ITR) filing. The workshop featured two key sessions: the first, led by Dr. A. Lydia Arockia Mary, Assistant Professor at Stella Maris College, Chennai, focused on tax planning strategies. Dr. Lydia provided an overview of effective techniques for optimizing tax liability through proactive financial management. The second session, conducted by Mr. Shreenidhi B S, Assistant Professor at St. Aloysius (Deemed to be University), Mangalore, threw light into the technical aspects of Income Tax Return (ITR) filing. Mr. Shreenidhi guided participants through the filing process, offering practical tips and advising on common pitfalls to avoid. The sessions were well-received, and the resource persons were commended for their clear and insightful presentations. This event underscores the Department of Commerce (PG)'s commitment to providing quality educational opportunities that equip students and professionals with essential skills for financial management.

Guest Lecture on "Upholding Integrity: Navigating Professional Ethics in Today's Workplace”

The Department of Commerce (PG) is organized a Guest Lecture on "Upholding Integrity: Navigating Professional Ethics in Today's Workplace” on 13-08-2024 between 2.40 PM to 3.40 PM in M Auditorium , Main Block for the benefit of our III Semester M.Com & M.Com FA Students. The resource person for the Expert Talk was Ms.Sonal Pawar M.Com., CMA., R & D Controller ,(Financial and Planning Specialist), ABB Ltd.

The Resource Person emphasized the critical importance of professional ethics in shaping students' personal growth and career success. The Expert Speaker effectively illustrated her insights with numerous real-life industry cases, making the session both engaging and informative. The session concluded with an interactive Q&A, where many students actively sought to clarify their doubts and deepen their understanding of the relevance of professional ethics in commerce and business.

Expert Talk on Design Thinking for Sustainable Innovation: Entrepreneurial Perspective

The Department of Commerce (PG) and Department of Social Work in association with Kristu Jayanti Incubation Centre organized an Expert Talk on Design Thinking for Sustainable Innovation: Entrepreneurial Perspective, on 18th November 2023, Saturday. Dr. D. Ravindran, Convenor and Innovation Ambassador, Kristu Jayanti Incubation Centre and Faculty (Marketing), School of Management, Kristu Jayanti College (Autonomous), Bengaluru was the resource person.

In today’s evolving economy, it is important for every individual to analyze their attitude towards business and to build a successful career in it. It is where entrepreneurship plays an important role. An entrepreneur is an individual who takes on the initiative and risk to start and manage a business venture, typically with the goal of achieving profit or addressing a specific need in the market. But in order to become a successful entrepreneur one must have proper training and guidance. Dr. D. Ravindran very clearly gave an overview of what is Entrepreneurship ,how to build a career in entrepreneurship , various facilities provided by the Kristu Jayanti Incubation Centre for promoting entrepreneurship among students by imparting various aspects of entrepreneurship. He also took up the examples of Steve Jobs and Thomas Edison to tell about their attitude towards coming up with new innovations and providing the solution for a problem.

Expert Talk on "Maximizing Your Wealth: Expert Tax Planning and Effortless E-Filing"

The Department of Commerce PG conducted an Expert Talk on "Maximizing Your Wealth: Expert Tax Planning and Effortless E-filing" on 18th August, 2023 from 2.00 pm to 3 pm for the III Semester M.Com & M.Com FA Students. Dr. CA Akhil Manuel, Faculty, Department of Professional Accounting and Finance, Kristu Jayanti College (Autonomous), Bengaluru, the guest speaker threw light on comprehensive insights and practical strategies for maximizing their wealth through expert tax planning techniques and effortless electronic filing (E-filing). The speaker emphasized the importance of efficient tax planning and how it can contribute to their overall financial well-being. By inquiring into the intricacies of tax regulations, deductions, credits, and exemptions, the expert talk empowered participants to make informed decisions that can legally and ethically minimize their tax liabilities

Expect a Lecture on Hedge funds

Department of Commerce (PG) organised an expert lecture on hedge funds by Mr. Arjun Shankar, Team Leader, State Street, Bengaluru. The lecture was conducted for first and second-year M.Com and M.Com FA students in A2 Auditorium, Third Floor, Admin Block at 10:00 AM. The resource person started with the basic financial concepts like equity, debentures, and mutual funds with various live examples related to stock markets in India and abroad. He also spoke about the capital, subscription of shares, and share allotment. He explained various mutual funds and existing mutual funds in India. He discussed open-ended and close-ended mutual funds with examples in India and abroad. He described derivatives, and types of derivatives contracts. The major area covered by the resource person was derivative contracts- forward contracts, futures contracts, option contracts, and swap contracts with various examples for each contract.

Expert lecture on Entrepreneurial and Professional Skill Development

Department of Commerce PG organized An Expert lecture on fundamentals of IPR for M. Com & M. Com FA Students on 16th February 2022. Prof. Dr.Mohan R Bolla, Principal, Kristu Jayanti College of Law, Bangalore was the resource person for the programme. The main objective of this Programme was to enable students gain awareness about the fundamental concepts of IPR, help them understand the various IP laws like copy rights , trade mark and issues related to patents The overall notion of this program was to encourage the student for start-ups and innovations.

Expert lecture on Entrepreneurial and Professional Skill Development For M. Com & M. Com FA Students

Department of Commerce PG organized An Expert lecture on Entrepreneurial and Professional Skill Development in association with Institution Innovation Council (IIC) and Kristu Jayanti Incubation Centre (KJIC) for M. Com & M. Com FA Students on 5th February 2022. Dr. Baba Gnana Kumar, Director for Consultancy & Corporate Training at Kristu Jayanti College (Autonomous), Bangalore was the resource person for the programme. The main objective of this Programme is to enable students to understand the basic concepts of entrepreneurship and prepare business plan to start a small industry and to enable students to learn the process and skills of creation and management of entrepreneurial venture.

Expert Talk on Wholesome Wellbeing & Leadership

Department of Commerce PG conducted an Expert Talk on Wholesome Wellbeing & Leadership on 30th September, 2021 via Zoom Application from 4 pm to 5 pm for the benefits of I & III Semester M.Com & M.Com FA Students. The resource person for the session was Dr. Capt. U. Thanesh, Associate NCC Officer & Assistant Professor, Department of English, RKM Vivekananda College, Chennai. The main objective of this session is to acquaint the students with the skills and knowledge required for enhancing one’s organic growth and wholesome wellbeing. The resource person threw a light on time management, stress management, leadership qualities, spiritual wellbeing, emotional intelligence, etc.

International Webinar on “The Future of Accounting towards Digital Skills in a Transformed World”

Department of Commerce (PG) has conducted International Webinar on “The Future of Accounting towards Digital Skills in a Transformed World” on 02-09-2021, from 3.30 PM to 4.30 PM through zoom platform. The resource person was Dr. Yousuf Al Balushi, Head, Accounting and Business Department, University of Technology and Applied Science (UTAS) Muscat, Sultanate of Oman. The resources person enlightened the participants on the need for having digital skills in the new era. He also elaborated about the advancements in financial technology and business. The participants interacted with the resource person and clarified their queries. There were 136 participants from various parts of the country.

Expert Talk on Union Budget 2021-2022

Department of Commerce (PG) organized a Virtual Expert Talk on Union Budget 2021-2022 on 2nd February, 2021 from 6 pm to 7 pm for final year M.Com and M.Com FA Students. Mr.Sudhakar Giridharan, Chartered Accountant was the resource person of this online session and threw a bird’s eye view on the significant highlights of Union Budget 2021-2022 presented by our Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman in the Parliament on 01st February, 2021.

Mr.Sudhakar Giridharan highlighted the core facets of the Union Budget 2021 in the light of Covid-19 and their implications on the ordinary people, business organizations, Government and Indian Economy as a whole. The major key points highlighted by the resource person are summarized below:

Total students 98 (58 from IV M.Com and 40 from IV M.Com FA) actively attended expert talk on Union Budget 2021-22 via Zoom Platform and the students have responded that the expert talk provided them a real-time information and knowledge on Union Budget 2021. They also felt that the session as a whole was very well articulated and delivered and the guest speaker made the virtual session more interesting and interactive so that the students had a good learning experience on the Union Budget 2021-22.

Online Expert Talk on “Professional Qualities Of Commerce”

The Department of Commerce (PG) organized an Online Expert Talk on “Professional Qualities of Commerce” via Zoom Platform on 9th October, 2020 from 3:30 to 5:00 pm for the benefit of the I Year & II Year M.Com & M.Com FA students. The resource person for the Programme was Dr. Baba Gnanakumar P, Professor & Director of Centre for Consultancy and Corporate Training, Kristu Jayanti College (Autonomous), Bengaluru. The aim of this expert talk was to inculcate students with the various professional qualities which are required by commerce students to prepare for job interview.

The students are the leaders of the next generation of any nation. Hence, they have to be groomed and trained to be people with excellent professional qualities. Dr. Baba Gnanakumar provided a very practical approach in his delivery as he included live examples, and famous personalities that exhibit these required traits and qualities. It was a very interactive and lively session which provided a vast learning experience for the students. The Guest Speaker covered various qualities and their prominence in today’s world. They are highlighted below:

• Self-branding: Self branding, or personal branding, is a form of marketing that an individual uses to create a uniform public image that demonstrates his or her values and overall reputation. Self-branding is important for students to recognize their attributes and qualities.

• Crisis Management: Students must be the best to handle the worst situations.

• Clients or Customers are King: Irrespective of where you work, always please your customers and ensure that they are satisfied with the service or product you provide.

• Be smart while working: Focus on smart work over hard work

• Expectation: Always deliver more than expected

• Communication: Communicate effectively and efficiently

• Praise: Praise your peers not yourself

• Knowledge: Share your knowledge with your social elements

• Happy: Be always cheerful and positive.

The students had a very enlightening session on the skills required by commerce professionals in today’s world. Be it in work or in personal lives, students have realized the benefits of adapting, evolving and utilizing these skill sets in order to enhance themselves and produce value addition in their work as well as to the society. The expert speaker kept the session very lively and provided various aspects on professional skills by enriching their learning experience.

This online expert lecture witnessed a positive response from 176 students from I Year & II Year M.Com & M.Com FA programmes. The expert lecture provided the students an enriching platform for acquiring professional qualities a commerce graduate must possess. The participants felt that this online expert lecture has supplemented them with an enriching learning experience where students could learn professional qualities and apply those qualities in real business environment. Thus an hour of informative and motivating talk on professional qualities of commerce was very much the need of the hour.

Online Expert Lecture on “Logistics & Supply Chain Management Strategy For E-Commerce”

The Department of Commerce PG organized an Online Expert Lecture on “Logistics & Supply Chain Management Strategy for E-Commerce” via Zoom Platform on 20th October, 2020 from 3:30 to 5:00 pm for the benefit of the first and second year students of M.Com & M.Com FA. The resource person for the Programme was Dr.R.Rajasekaran, Associate Professor, Department of Commerce, PSG College of Arts & Science (NIRF Ranked:25), Coimbatore, Tamilnadu.

The aim of this expert lecture was to provide the student fraternity a learning experience on the various aspects and facets of Logistics and Supply Chain Management for e-commerce. This session shed light on the major challenges, issues and opportunities associated with Logistics and Supply Chain Management of e-commerce business in the wake of the covid-19 pandemic.

The resource person Dr.R.Rajasekaran delivered a fruitful and enriching talk on the various dimensions of Logistics and Supply Chain Management strategy with a focal view on e-commerce during Covid-19. The expert speaker clearly explicated that the Logistics and SCM strategy is a critical factor in the long-term success of a business. Effective Logistics and SCM is a characteristic shared by many prosperous companies. Knowledge on the concept of logistics and SCM can provide the students a competitive edge for pursuing their professional careers in the corporate world. Some of the views and insights the expert speaker highlighted are summarized below:

- The carefully researched and developed strategy of the supply chain.

- The source of the materials used to make the goods to sell.

- The efficient production of the manufacturing process in getting the goods ready for the market.

- The delivery mechanisms and logistics that move the products to the consumers and distributors.

- The system for managing the return of defective or unwanted products.

- Other significant aspects like inventory management, storage, warehousing, material handling, picking, packaging, shipping, dispatching and Information & control.

This online expert lecture witnessed a positive response of 160 students from I Year & II Year M.Com & M.Com FA programmes. This expert lecture provided the students an enriching platform for acquiring knowledge and getting acquainted on various aspects of Logistics and Supply Chain Management strategy for e-commerce. The participants felt that this online expert lecture has supplemented them with an enriching learning experience where students could grasp fundamental concepts and be able to apply the same in real-life scenarios. Thus an hour of informative and inspirational talk on the scenarios of Logistics & SCM strategy in the light of E-Commerce was very much the need of the hour.

Online Guest Lecture on Environmental Social Governance Impact on Global Credit Markets

The Department of Commerce PG, Kristu Jayanti College (Autonomous) organised Online Guest Lecture on “Environmental Social Governance Impact on Global Credit Markets” on 29th May, 2020 at 10 am to 12 pm (IST) for the benefits of IV Semester M.Com & M.Com FA Students. Nearly 89 students actively participated in the Online Guest Lecture through the virtual platform Zoom. The resource person for the Online Guest Lecture was Mr.S.Subbramanya, Lead Financial Data Analyst, Moody’s Investors Services Support Centre, Bengaluru.

At the outset, the session was hosted by Prof. Madhudruvakumar, Faculty, Department of Commerce PG and was inaugurated by Dr. Fr.Augustine George, Vice Principal, Kristu Jayanti College (Autonomous). This online guest lecture session was proceeded with a Video by Allianz Global Investors on the basic concept of Environment Social Governance (ESG) covering the importance of socially responsible investment and its impact on profitability of the companies. Then the resource person spoke about the introduction of ESG in 1991 during Industrial revolution in U.S where a meeting was conducted among 50 companies in 2004 to discuss about ESG and financial crisis in U.S. The concept of ESG was considered important for sustainable growth of the companies.

The guest speaker also discussed about how the ESG and credit market correlated in terms of financial products, company profit and credit rating. Generally, companies are evaluated on the basis of quantitative and qualitative aspects (e.g., balance sheet and shareholders’ value) and also through company’s vision and social responsibility and credit rating like best ESG score rated with ‘AA’ and ‘AAA’ is considered as best score for companies. Indian Companies like HDFC bank and Tata are rated with best ESG score. The speaker concluded with ESG products i.e., Green Bonds, Social Bonds and Sustainability Bonds which are available for socially responsible investment and also discussed some limitations of ESG like cost of capital, standards and terminology, ESG adoption and ESG on Global Markets.

The guest speaker has thrown a lime light on the following areas:

• Environment Factors: Use of energy efficiently by companies, use of renewable energy which is less polluting and reduces climatic change, responsibility for managing wastes, having responsible practices across value chain such as no deforestation policies or even animal welfare, disclosing information on all environment policies, etc.

• Social Factors: Diversity and inclusion, safe and healthy working, labor standard, good relations with local community, protecting shareholder and stakeholder’s welfare, etc.

• Governance Factors: Tax strategy, corporate risk management, executive compensation, donations and political lobbying, prevention of corruption and bribery, board structure and brand, protecting shareholders’ interest, etc.

The resource person explained in details the various aspects and nuances regarding the impact of environmental social governance on global credit markets. The programme was well planned and designed for enhancing knowledge of the students in the domains of Environment Social Governance (ESG). This online guest lecturer was virtually organized and delivered via Zoom platform. This online guest lecture enriched and updated the knowledge and competency of the IV M.Com and M.Com FA students about the realistic perspectives of impact of environmental social governance on the global credit markets.

Online Webinar on Impact of Banking and Financial Sector in the Post Covid 19 Economy

The Department of Commerce PG, Kristu Jayanti College (Autonomous) organised Online Webinar on Impact of Banking and Financial Sector in the Post Covid 19 Economy on 19th May, 2020 at 3 to 4:30 PM (IST). About 830 faculty members from different parts of the country attended Online Webinar on the impact of various aspects and nuances of Banking and Financial Sector on Indian economy during Post Covid 19.

The resource person for the Online Webinar was Mr.Rayner Ephraim, Assistant General Manager, South Indian Bank. The guest speaker has thrown a lime light on the following:

• Robust Indian Financial System

• The role and significance of Fintech, Industrial Revolution 4.0 and Digital Platforms during pandemic time in India

• Better focus on the liquidity of essential services rendered by Banking and Financial Sectors.

• Government, RBI & SEBI reforms on Banking & Financial Sectors such as NBFCs, Mutual Funds, Insurance, Stock Markets, Capital Markets, Commodities Market, etc in India during Covid 19 lockdown.

The resource person explained in detail the various aspects and nuances of banking and financial sector and their impact on the Indian economy during Post Covid 19. The programme was well designed, organized by Zoom platform and appreciated by the participants. This Online Webinar enriched and updated the knowledge of academicians, industrialists and scholars about the major issues and challenges faced by Banking and Financial Sectors to provide banking and financial services during Post Covid 19 economy in India.

International Lecture Series

Department of Commerce PG organized an International Lecture Series on 12th July, 2019 at Conference Hall II (PG Block) from 3.30 pm to 4.30 pm. Ms.Teresa Jacobs, Director, ISDC, UK delivered an interactive and inspiring lecture on importance of higher education in today’s dynamic business environment.

The lectures related to different approaches adopted in the field of higher education to face the today’s competitive business environment. The guest speaker has thrown a light on the significance of higher education in meeting holistic development of student community. She has also highlighted the role of parents in nurturing and reinforcing learning bahavious of the students in today’s modern era.

Total 89 students (50 from III M.Com & 39 from III M.Com FA) attended International Lecture Series. The participants had an interactive experience with the guest speaker in the major thrust areas of the higher education.

Expert Session on Budget 2019-2020

Department of Commerce PG has arranged an Expert Session on Budget 2019-20 on 6th July 2019 at Mini Audi IV (UG Block) from 9 am to 1.45 pm. Mr.Sudhakar G, Director – Taxation, Deloitte delivered highlights on post live budget 2019-20 presented by our finance minister Ms.Nirmala Sitharaman on 05th July, 2019.

Mr.Sudhakar has given a bird’s eye view on Budget 2019-20 and made the major budget highlights as given below:

• Total Expenditure: The government is estimated to spend Rs.27,86,349 crore during 2019-20. This is 13.4% more the revised estimate of 2018-19.

• Total Receipts: The government receipts (excluding borrowings) are estimated to be Rs.20,82,589 crore, an increase of 14.2% over the revised estimates of 2018-19.

• Transfer to states: The central government will transfer Rs.13,29,428 crore to states and union territories in 2019-20. This is an increase of 6.6% over the revised estimates of 2018-19.

• Deficits: Revenue deficit is targeted at 2.3% of GDP, and fiscal deficit is targeted at 3.3% of GDP in 2019-20. The target for primary deficit (which is fiscal deficit excluding interest payments) is 0.2% of GDP.

• GDP growth estimate: The nominal GDP is estimated to grow at a rate of 12% in 2019-20. The estimated nominal GDP growth rate for 2018-19 is 11.5%.

Total 89 students (50 from III M.Com & 39 from III M.Com FA) attended expert session and the students have felt that the expert lecture provided them real-time information about the budget 2019-20. They also responded that the session as a whole was very well articulated and delivered and the guest speaker made it interesting and therefore making a good learning experience.

GOODS & SERVICES TAX (GST

Date: 17.01.19

Classes Attended & Number of beneficiaries: I & II Year M.Com & M.Com FA & 172

Name and details of the Resource Person: ) Mr. K P Srinivas, FCA & Mr.Georgy Mathew, Senior Manager, Verma & Verma, CA Firm

Objective:

a) To enable the students understand the nuances and dynamics of Goods & Services Tax (GST)

b) To provide the students a comprehensive bird’s eye view on challenges and issues of implementation of One Nation, One Tax, One Market GST in India.

The key note speaker Mr.Georgy Mathew had opened the talk on Goods & Services Tax (GST) by inviting students to have common questions, doubts and clarifications for the open interaction and discussion. The following concepts of GST were requested by the students to have a comprehensive view on the GST.

a) Input Credit Tax

b) Central Excise Duty

c) Service Tax

d) Additional Excise Duties

e) CVD (levied on imports in lieu of Excise duty)

f) SAD (levied on imports in lieu of VAT)

g) Excise Duty levied on Medicinal and Toiletries preparations,

h) Surcharges and cesses

i) Central Sales Tax

Mr.Georgy Mathew had introduced the effects of GST as a game changer, allowing, which allows even service-providers to claim Input Tax Credit. He allowed students to make a mention of all the concepts they know under GST and listed them down as the agenda of the meeting, and explained how GST subsumed the previous indirect tax regime and encouraged students to understand the subject further.

Mr. K Srinivas, complemented by Mr. Joji Matthew, had thrown light on objectives of GST towards illuminating the cascading effect of Tax, as a Value-Added Tax and a chain of tax credit in b2b transactions to be borne by the final consumer.

Mr. K Srinivas introduced the classification of Goods under HSN codes, the composition scheme, compensation cess and emphasised the impact of the new GST Network. He explained the registration process and Pricing mechanism under GST invoicing against the old system.

Mr. Joji Matthew then went into Reverse Charge Mechanism vs Forward Charge Mechanism and filing of returns under the common GSTR 3B and GSTR 1 to be filed on a monthly basis and GSTR 4 to be filed quarterly as well as refunds in case of wrong filing of returns, export and for low output tax with present-day examples. They illustrated the concept of GST in the present-day scenario and thus, concluded the session with many active interactions with the students. The Guest Speakers have thrown a light on the following which have been replaced by the GST.

• Central Excise Duty

• Commercial Tax

• Value Added Tax (VAT)

• Food Tax

• Central Sales Tax (CST)

• Introit

• Octroi

• Entertainment Tax

• Entry Tax

• Purchase Tax

• Luxury Tax

• Advertisement tax

• Service Tax

• Customs Duty

• Surcharges

Dynamics Of Forex And Commodity Markets

Date: 22.12.18

Classes Attended & Number of beneficiaries: I & II Year M.Com & M.Com FA

Name and details of the Resource Person: Mr.Vivek & Mr.Seetharaman, Managers, Karvy Stock Brokers

Investors program awareness- they include capital markets, money markets, commodity markets, etc., are all interlinked. The economy of any country is dependent on oil market, forex market and gold market. Gold is highly important asset class in the country because it serves as a security which is financially termed as best hedge against inflation. Demand for gold is globally very important and not just within the nation.

Mr.Vivek stated about the high impact and the interlinks between gold market, oil market, and forex market. 10 golden rules were advised for investing in the commodity and stock market. Much more of his knowledge and experiences were shared with the gathering. He also stated about the availability of investment facilities in Bangalore and Hyderabad for the one’s investment decision making.

The department of Commerce (PG) conducted a guest lecture on 29th July 2017 for 160 Students of M.Com & M.Com FA students. Ms. Rashmi. S, Director, Deliotte was the resource person.The key objective was to know about the overview and concept and benefits under GST.

The session covered many topics like existing indirect tax vis-à-vis GST, Pro’s and Con’s of GST, Taxes subsumed under GST, GST – basic features, destination based tax, supply, GST rates, GSTN portal, registration and reverse charge mechanism. The resource person explained various concepts through life time examples which cleared many myths about GST among students.

Lecture 1: Capital Line Software

Department of Commerce (PG), organized a guest lecture for 81 M.com and M.com(FA) students on August 15, 2016. Mr.Dr.Debashish Pal –Academic Coordinator, Department of applied economics university of Cincinnati, USA. addressed the students on CAPITAL LINE SOFTWARE

He addressed the students on how software can be implemented in various accounting techniques in calculations. He executed a problem in accounts using online software and also showed how to copy data to Ms Excel sheet from online software for different calculations in all the form of accounts. He taught how to do a comparison for two years data from the available balance sheet of various companies through online in excel. That includes comparative balance sheet, income statement and Common size income statement and balance sheet. Then he spoke about Ratio Analysis, how different types of ratios can be calculated using Data that is available through online in MS Excel .

The session was interactive with questions from students on how effective online software is in implementing capital and accounting techniques.

Lecture 2: Convergence of IFRS and Ind as-Present Scenario

The PG department of commerce organized a one day guest lecture on convergence of IFRS and Ind as-Present Scenario for M.Com & M.Com (FA) students on Tuesday 16th August 2016. The chief resource person for the day was Mr Shirish Shah. The session started off with the background of IFRS and how it was originated. To understand Ind AS in a better way, he talked about:

• Fixed Assets or inventories purchased on deferred credit terms having financial elements and its implications on tax

• Unbundling of multiple elements from the sale price where required, and its implications on TAX, VAT, and Service Tax.

• Redeemable preference shares carrying fixed rate of dividend considered a liability under Ind AS and its implications on MAT and TDS

• Measurement of interest at effective interest rate rather than the contracted rate to recognize interest income and expenses and its implications on TDS, MAT on account of change in book profit.

• Greater use of fair value (FV) as measurement basis and its implications on MAT on account of book profit.

The session was engaging on account of enthusiasm of students as well as the Resource person.

Lecture 3: Managerial Economics

The PG Department of Economics conducted a guest lecture for an hour on Managerial Economics for M.Com, M.Com (FA), MA (Economics) and BA Students on Wednesday, 21st September 2016.The resource person for the day was Dr.Debashish Pal.

The session began with an introduction to game theory in managerial economics. Dr. Debashish Pal explained about game theory and its major role in managerial economics. He talked about how game theory is included in concepts of Economics and what are the methods or tricks that are used to get equal equilibrium in the economy using game theory.

With activities and question and answer sessions, the guest lecture proved to be an interactive one.

Lecture 4: Investment Banking & Financial Leverage

The PG Department of Commerce conducted a guest lecture on Investment Banking and Financial Leverage for M.Com, M.Com (FA) students on 16th December 2016. The resource person for the day was Mr. George Karammel, Investment Banking Analyst at Barclays.

The session began with Mr. George Karammel’s introduction on Investment Banking. The practical as well as theoretical aspects of investment banking were covered during the guest lecture conducted for two hours by Mr. Karammel. He made the session lively and interactive through the narration of vivid examples for various financial concepts.

Department of Commerce (PG), organized a guest lecture for the M.com students on August 16, 2013. Prof. K. Kanishka, Head of department, BBM, St. Joseph’s Evening College addressed the students on public private partnership model.

He began the speech by defining PPP Model and explained the numerous variables involved in PPP Model. He also mentioned the potential benefits of the model which are: mobilization of more resources, cost effectiveness, accelerated delivery, reduces corruption and waste and enhanced social service.

“PPP Model will be successful only if certain essential factors are taken care of such as policy factors, transparency, cost and risk sharing arrangements,” Prof. Kanishka added.