Investors Club

INTRODUCTION

Kristu Jayanti (Deemed to be University) initiated “INVESTORS’ CLUB” for all UG students to train on Basics of Stock Market, Investment Opportunities and develop skills. Investor Training Programme bridging the gap between the classroom and the financial workplace.

The core ideology of the club is cultivating the interest of students in finance as an academic subject and also as a career option. The club activities cover a broad range of domains in finance like investment avenues, trading and settlement. The core activities include conducting knowledge sessions, quizzes, case analysis, career preparation session, mock trading and guest lectures, experts from BSE, NSE, Mutual Funds, NCDEX and MCX to educate the KJC students and to create awareness regarding the Stock market and commodities market (capital market) and in particular working of the stock trading in Indian exchanges by virtually.

OBJECTIVES OF THE INVESTORS’ CLUB- To give practical training on online trading though virtually

- To create awareness about new investment avenues

- To help students on functioning of stock market and its related aspects

- To insight the investors’ education (IPF) offered by capital markets

The registered members meet once in a week at appropriate time whenever students are having free hour and discuss on current market updates. The members are also clarifying their doubts regarding the functioning and trends of markets. The Investors’ Club covered the following topics like

- Equity Markets in India

- Asset Allocation (Investment Channels)

- Trading in Stock Market

- Why not other investments,

- What is intraday and delivery day,

- Methods of orders,

- About Mutual Funds,

- Stock Market Indices (how to calculate SENSEX) and Speculators,

- Truth about BITCOIN Exchange,

- Masala Bonds,

- Non-convertible Debentures,

- What are the pros and Cons of Stock market and BITCOIN Exchange

- Capital Markets

- Technical Analysis

- Screening Live Trading

- Virtual trading competition in association with DSIJ, Track Invest and ICICI Direct

- Discussions on share market trends with Club members through news and evidences

- Case Study - Portfolio Construction (Stock Market)

- Case study – Investment Plan

- Quiz on selected investment

- Flipped classes

- Knowledge sharing

Overview of Securities Markets and Career growth

Date: 26/11/2021

Investors Club organized skill development lecture on Overview of Securities Markets and Career growth. The first session was led by the Ms. Indira, Senior member of SEBI talked about what is stock market and how to invest in stock market, buying and selling shares in securities markets and also highlighted structure of securities market, dos and don’ts of investment.

Second session led by Mr. B. Badrinaranan, BSE-IPF spoke about the career growth in stock markets, he spoke about what are the opportunities available in the markets and what are the various positions in the field of stock markets. The session concluded with an open discussion with the students wherein the resource persons clarified their queries with regard to stock markets and opportunities. The session helped the students to understand and functioning of stock markets and job opportunities in the capital markets.

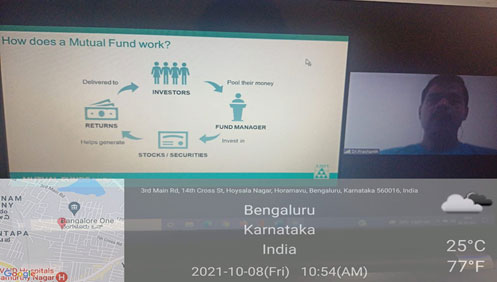

Mutual Fund Operations

Date: 08/10/2021

Investors club conducted skill development session on Mutual Fund Operations on the commemoration of World Investors Week. The session led by Dr. Prashanth Batt, Professor, Canara College, Mangalore. He began the session with an introduction on what to do with your money- Save, Spend and Invest. Dr. Prashanth further spoke about the inflation of money and goal based investing. He gave a brief insights on various options for investment such as Gold, Stocks, Bonds, Insurance, Mutual funds etc. He Enlighted the process of investing in mutual fund and the benefits of it. Additionally he suggested students to invest in Long Term Mutual Fund such as SIP, STP, etc. Finally the session was windup with the answers who raised the questions.

Investment VS. Trading

Date: 04/10/2021

Investors Club oragnised skilled development session on Investment vs. Trading for B.Com students on 04/10/2021. The session was led by Mr. R.P Joshi, NISM Certified and SEBI Registered spoke about what is wealth creation and what are the different asset classes. He also showed us performance of various asset classes and talked about equity as an asset class, best suited for wealth creation. Then he taught us what is trading, investing, intraday trading, positional trading and also short term investing, long term investing.

He spoke about honeycomb investing, which is Mutual Funds. How mutual funds work. Also what kind of returns we can get on mutual funds and taught us the best way of investing in mutual funds. The session was informative and helpful to the students. The session concluded with a Vote of Thanks

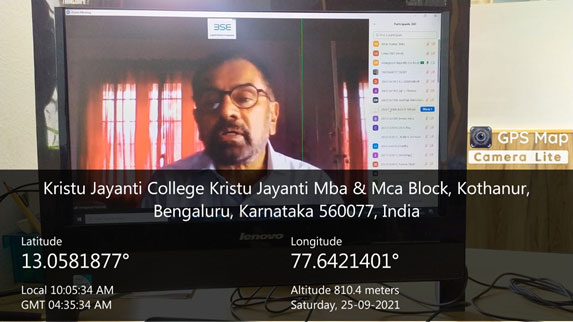

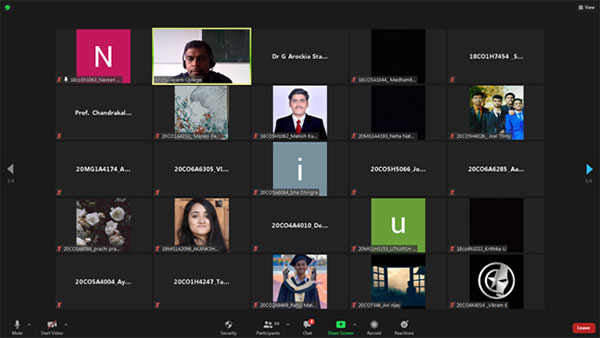

Capital Markets Awareness

Date: 25-09-2021

Investors Club organized skill development lecture on “Capital Markets Awareness” on 25 September 2021 through virtual platform. Mr. Venugopal R, Senior Associate, Lotus Knowlwealth Pvt. Ltd addressed the students. Mr. Venugopal created awareness among the students about functioning of capital market. The trading process, trading timings, and risk involved in capital market were explained to the students. Mr. Pankaj Mathkar described about the categories of assets along with its salient features focusing on return, safety and liquidity. Mutual funds, its types and various schemes of mutual fund was also briefed to the students. The speaker gave detailed explanation on do’s and don’ts of investors, rights of investors, obligations of investors and investor grievance redressal mechanism. He also provided guidance to the students about preferred investment scheme for students. The session ended with open discussion. The queries raised by students their regarding capital market investment were clarified by the speaker. The skill development lecture helped the students to create awareness about stock market and how to invest the money by diversifying risk.

Expert Lecture - Commodity Derivative Markets and Opportunities

Date: 28/10/2020

Classes Attended & Number of beneficiaries : 239- V-B.Com Finance Specialization Students and Honours

Name and details of the Resource person

1: Mr. NIRAJ SHUKLA

AVP, NICR (NCDEX), New Delhi

Resource person 2

: Mr. RAM GOPAL YADAV Deputy Manager, Knowledge Management, NICR, New Delhi

The Investor's Club of Kristu Jayanti College organized a guest lecture on Commodity Market and its Opportunities. The resource persons were Mr.Niraj Shukla (AVP,NICR), and Mr.Ram Gopal Yadav(Deputy Management, Knowledge Management ,NICR) .The session began with an insightful introduction about the commodity market , functioning of the market, types of commodities ,Regulatory Functions and other relevant details .The session broadened the views of the commodity market for the audience. The opportunities in the Commodity Market and the courses available in the NICR were also explained in brief. The students gained knowledge on commodity markets and understood the trading procedures in commodity markets. The presentation ended with an interactive Q & A session.

World Investor Week - 2020

World Investor Week is a global campaign to raise awareness and highlight the investor education and to protect initiatives of security regulators. The Investors’ Club, Dept of Commerce organized a week-long program from the 6th of October to the 12th of October,2020 to raise awareness about the different aspects of Investments. The resource persons for the sessions conducted during the World Investor Week were Prof. Kiran Kumar and Prof. Arti Singh, Faculty coordinators of investors club.

The sessions covered information on various topics such as Investment opportunities, Mutual Funds, the Do's and Don’ts, Mantras of Investment, Regulatory Bodies and Methods to trade in the market. The participants were introduced to a Virtual Trading Challenge with the help of DSIJ which helped them experience how real time trading in stock market functions. The World Investor week proved to be a very useful session as it helped the participants gain theoretical and practical knowledge in the field of Trading and Investments.

Guest Lecture on Mutual Funds in India

Date: 28/01/2020

Venue: Mini Auditorium – I (Admin block) 2nd -Floor

Time: 12:00 PM

Number of beneficiaries: 120

Name and details of the resource person: Mr. VARRUN YOGANATHAM, Regional Manager - RBD Reliance Nippon Life Asset Management Limited, Bangalore

Mr. Varrun focused his session mainly on the Investment channels (Asset Allocation) and Tax planning for savings and investment; prominence was given to Mutual Fund which is considered to be most one of the most interesting investment avenues in India.

The session began with discussion on investment basics, key factors involved in investment and returns. The following points were discussed

- Mutual Funds: Second, he spoke about the meaning and importance of mutual funds with advantages followed by modus operandi of mutual funds, types, analysis and Equity scheme for long term.

- Investing in Mutual funds through SIP and its benefits: Finally, he emphasized the concept of SIP, how it is beneficial to investors in the form of Insurance and tax this was explained with practical examples.

OUTCOME: participants found the session to be extremely useful and informative. The session helped the participants to gain more knowledge about investment specially Mutual Funds (SIP). They were posed several questions to the guest and all the doubts were addressed by the speaker.

Date: 30/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 50 UG Registered students

Topic: About Wealth Management

Name and details of the resource person: Prof. K. KIRAN KUMAR, Investors Club, Coordinator, Faculty of Commerce (UG)

On the occasion of World Investor Week, the KJC Investors club initiated value added course to the registered students and giving 2 credits as part of their academic career, with regard to this the following topics covered under the first session i.e., wealth management. This session led by the Mr. K.Kiran Kumar, club coordinator, he spoke about meaning, importance of wealth management. Moreover, he taught about wealth management process with live examples followed by Investor life cycle.

Date: 10/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 27 UG Registered students

Topic: Portfolio Construction

Name and details of the resource person: Prof. K. KIRAN KUMAR, Investors Club, Coordinator, Faculty of Commerce (UG)

The session led by Mr. K. Kiran Kumar, Faculty coordinator, the following topics covered by Mr. Kiran in his session, objectives of portfolio, Approaches and Portfolio Construction.

First he started with portfolio construction activity with given proforma and asked the participants to share their knowledge and experience with other students, on what basis they have created portfolio and what kind of factors applied. Secondly, he spoke about two important objectives of portfolio construction with regard to selection of stock and determining objective. Third, he taught about approaches like traditional and modern. Finally, he highlighted the last concept that is construction of portfolio with process and given more examples for every step.

Date: 09/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 27 UG Registered students

Topic: Trading and Settlement (types of Order and Tradings)

Name and details of the resource person: Prof. K. KIRAN KUMAR, Investors Club Coordinator, Faculty of Commerce (UG)

The session led by Mr. K. Kiran Kumar, Faculty coordinator of Investor Club, he highlighted the topics of How to sell and buy with different types of trading through different orders in stock market like market order, limited order and GCT orders with examples. Further, he spoke about the process of trading and settlement and how it starts and end like finding a seller and buyer at one place like one line trading once it found, next the order will go to broker and depositories limited with exchange of cash and securities and said about T+2 settlement.

Date: 05/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 44 UG Registered students

Topic: Stock Market Indices and Speculators

Name and details of the resource person: Prof. K. KIRAN KUMAR, Investors Club, Coordinator, Faculty of Commerce (UG)

Mr. K. Kiran Kumar led the session on Sensitivity Index and Speculators, he delivered the lecture on how to calculate sensitivity index and what are the factors to be considered for selecting 30 companies in BSE-30. Secondly he discussed about different types of speculators generally found in stock market and also spoke about their activities or functions in stock market.

Date: 04/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 48 UG Registered Students

Topic: MUTUAL FUNDS AND SCHEMES

Name and details of the resource person: Dr. ARTI SINGH, Investors Club, Coordinator, Faculty of Commerce (UG)

Dr. Arti singh, Faculty coordinator, insight about Mutual Funds, Advantages and disadvantages of mutual funds, Schemes of mutual funds and types of risk.

First she spoke about meaning and importance of mutual funds, she also discussed the advantages and disadvantages of MF followed by different schemes of mutual funds which is available in the market and she given examples of schemes like equity funds, tax savings funds and gilt edged funds etc., Finally, she discussed about types of risks.

Date: 03/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 49 UG Registered Students

Topic: Trading in Stock Market (BSE and NSE)

Name and details of the resource person: Dr. ARTI SINGH, Investors Club, Coordinator, Faculty of Commerce (UG)

This Guest Lecture was completely about “Trading in Stock Markets and about BSE and NSE”. Madam, spoke about the functions of stock market and explained in a detailed manner along with the classification of stock market as primary & secondary. Further adding Dr. Arti spoke about eight players in primary market along with their roles in primary market follower by different stock exchanges of India like Bombay Stock Exchange [BSE], National Stock Exchange [NSE], Multi Commodity Exchange [MCX], Over the Counter Exchange of India with their history and functions.

Date: 01/10/2019

Time: 3:30-4:30

Classes Attended & Number of beneficiaries: 50 UG Registered students

Topic: Equity Markets in India

Name and details of the resource person: Mr. THILAK RAJ, Regional In-charge, BSE –Bangalore

Second session led by Mr. Thilak Raj and he spoke about Equity Capital Markets in India and methods of selling and buying in stock market followed by the precautions before investing in stock market.

Firstly Mr. Thilak Raj, who was Regional in-charge of BSE (IPF) Ltd., Karnataka. He spoke about BSE and brief introduction on it. He showed some videos on Traditional Trading which was followed by BSE before 1996 and said some physical signs they used before when trading. Secondly, he spoke about importance of stock exchange in the role Indian economy and given some important tips to the participants students.

Student Life